The MSM has completely no protection of treasured steel worth appreciation and the insane silver worth run-up in 2026. The financial system is blowing up in actual time they usually’re not even telling you about it.

I assume everybody else has been frantically stacking silver for the reason that pandemic, proper? At this level it’s considerably outperforming BTC.

Silver is now not trailing gold however main your entire commodities parabolic worth motion. Costs surged into the $90s-$110 vary this month, capping a historic run that has now delivered roughly 53% features year-to-date in 2026, on high of a 50% rally in 2025.

Lower than 9 months in the past, silver traded close to $33. The transfer since then has been vertical. Right here’s what you’ll want to know if the silver worth will outperform BTC.

DISCOVER: 20+ Subsequent Crypto to Explode in 2026

Why Is Silver Worth Pumping? Industrial Demand Is Driving a Bodily Provide Squeeze

Not like gold, silver’s rally is being powered by industrial necessity. Information compiled by the Silver Institute reveals industrial consumption hit roughly 680 Mn ounces in 2024, accounting for practically 60% of whole world demand.

Vitality transition demand for AI, tech and all of the shiny new EVs that Elon Musk is bragging about are doing a lot of the heavy lifting:

Photo voltaic PV installations are projected to succeed in ~665 GW in 2026, consuming an estimated 120–125 Mn ounces.

Electrical car output is forecast at 14–15 Mn models, including one other 70–75 Mn ounces.

Grid upgrades and information heart growth contribute an extra 15–20 Mn ounces.

“Silver breaking via $100 isn’t a traditional correction. It is a bodily brief squeeze that overtook forecasts by years,” mentioned market analyst Bartoszek.

In the meantime, mine provide has stagnated. World manufacturing peaked round 2016 and has been drifting decrease since.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

Crypto Weak spot Highlights Capital Rotation Into Laborious Belongings

From a technical standpoint, silver has decisively cleared the $100 psychological degree and closed above it, turning former resistance into assist. The 200-day EMA, nonetheless close to $52, highlights how prolonged and highly effective this transfer has been.

99Bitcoins analysts at the moment are floating upside targets between $200 and $375, based mostly on historic log-scale breakouts.

The gold-silver ratio has collapsed from roughly 120:1 in April 2025 to about 46:1 as we speak, its lowest degree since 2011. Traditionally, sustained ratio compression has coincided with silver outperforming late-cycle commodities and threat property alike.

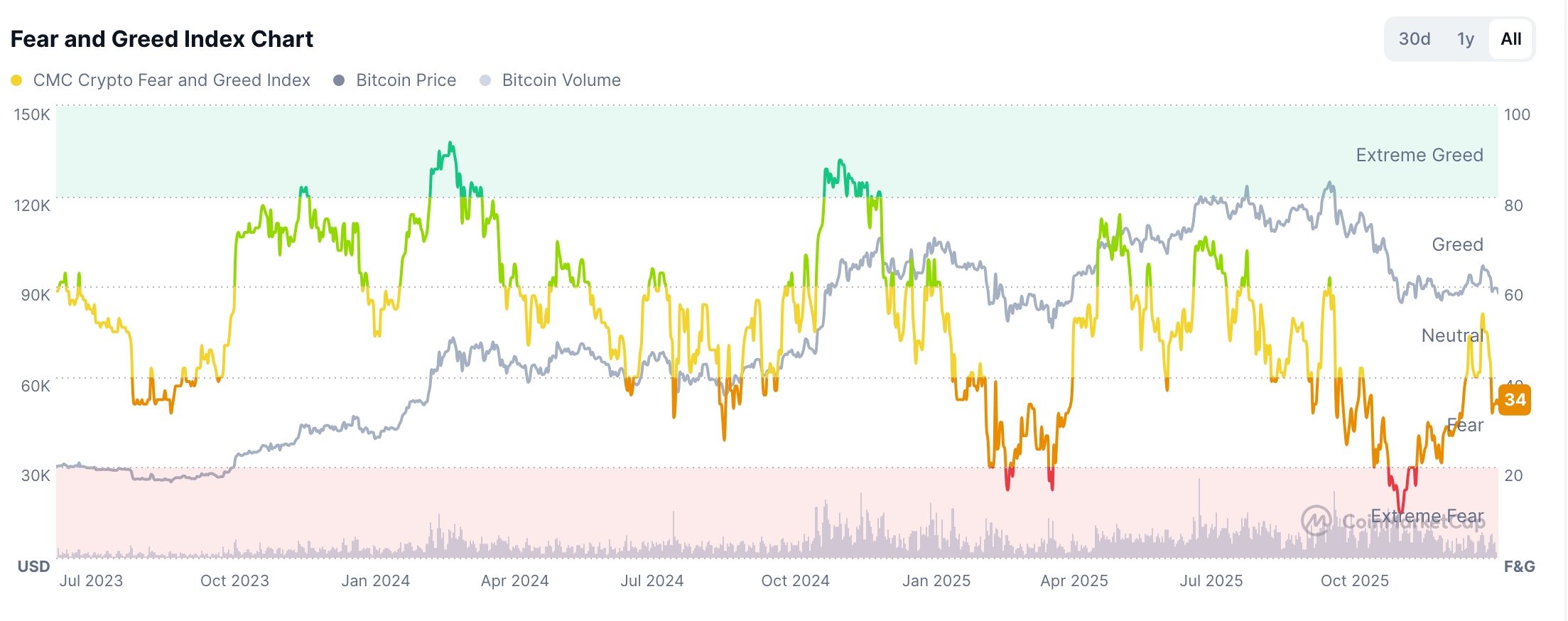

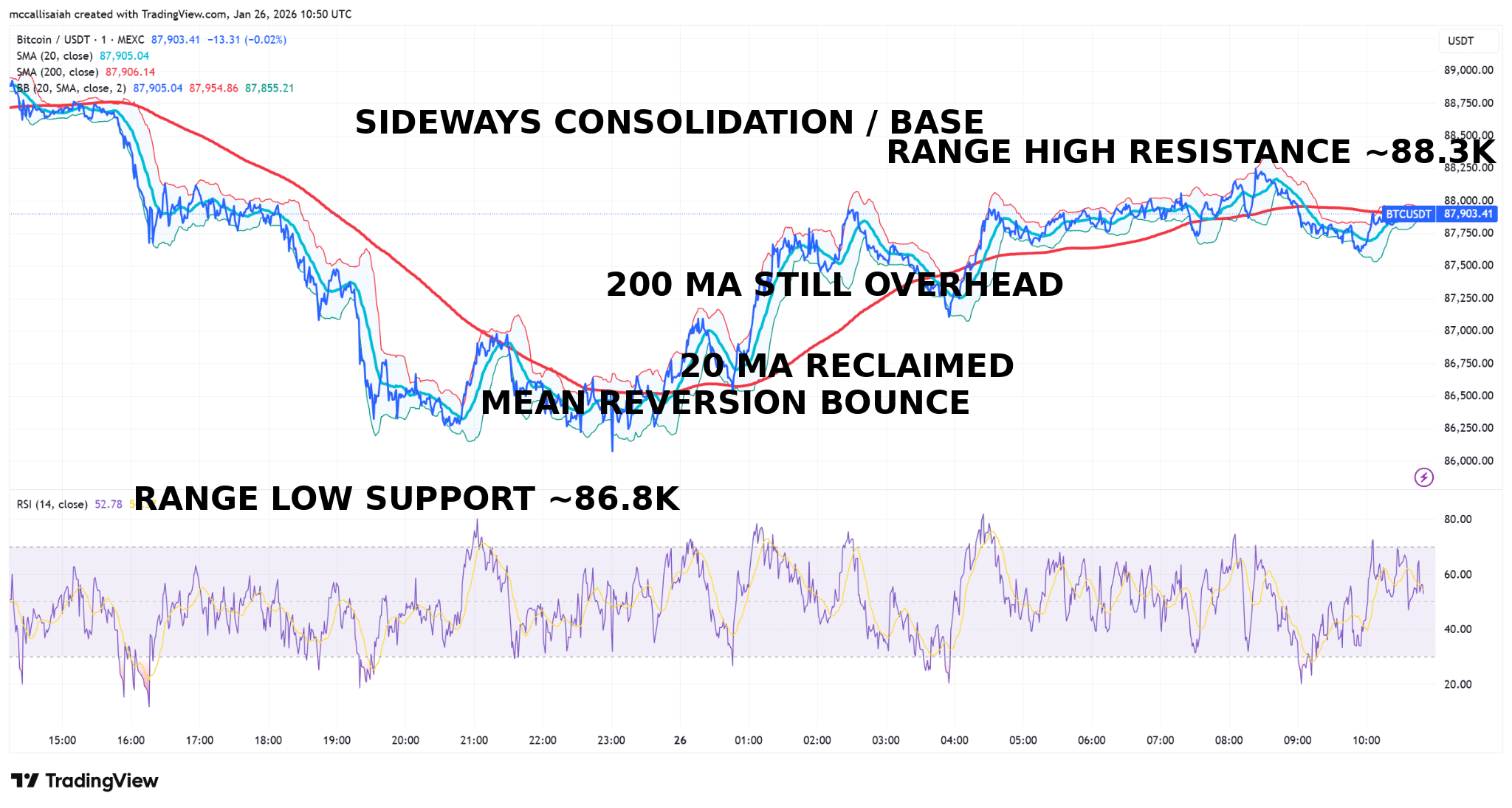

Whereas silver and gold hit document highs, crypto bleeds out. Bitcoin dropped beneath $88,000, Ethereum fell towards $2,800, whole market cap sank beneath $3 Tn. The Worry and Greed Index sits at 34-deep in panic mode.

ETF flows verify it with Bitcoin funds shedding over $1 Bn year-to-date whereas gold and silver ETFs pulled in billions. When liquidity dries up and narratives collapse, onerous property win.

Talking as a very long time silver stacker, most of the loudest silver buyers are vacationers right here. They FOMO’d in at $55 and suppose they’re Ray Dalio. Actual OG’s keep in mind when Bitcoin lagged behind Gold’s 2020 rally, and began going up 7 months later, giga pumped 3 occasions more durable and longer.

It may not look like it now however that state of affairs remains to be prone to play out.

EXPLORE: King of The Decade? Analyst says Bitcoin Worth Returns Will Beat Gold and Silver

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Knowledgeable Market Evaluation

Key Takeaways

The BTC USD pair and US greenback, generally, is getting cooked. We’re starting to see hyperinflation.

The MSM has completely no protection of treasured steel worth appreciation and the insane silver worth run-up in 2026. The financial system is blowing up.

The publish Silver Worth Vs BTC USD: Which Is a Higher Funding in 2026? appeared first on 99Bitcoins.