Liquidity supplier (LP) tokens are one of many cogs that assist decentralized finance work. For a lot of newcomers, they’re additionally fairly complicated. Should you’ve ever used a decentralized alternate, you’ve relied on liquidity swimming pools and the customers who fund them, even for those who didn’t notice it. LP tokens clarify how this technique works behind the scenes. They present what occurs while you present liquidity, how rewards are tracked, and why decentralized exchanges can operate with out conventional market middlemen.

On this information, we’ll break down what LP tokens are, how they work, and why they matter in decentralized finance, utilizing easy explanations and actual use circumstances that will help you perceive the place they match into your crypto journey.

What Are LP Tokens in Crypto?

Liquidity supplier tokens (LP tokens) are tokens, issued particularly to liquidity suppliers inside a decentralized alternate (DEX). Often, these DEXs run on an automatic market maker (AMM) protocol, which implies they use sensible contracts and liquidity swimming pools to keep up their operations, as an alternative of order books. This permits them to mechanically set costs and facilitate buying and selling.

Hottest swaps distribute LP tokens to their liquidity suppliers.

What Are Liquidity Suppliers?

A liquidity supplier (LP) in crypto is both an individual or a company that provides tokens to a buying and selling platform, normally a DEX. This fashion, there are all the time belongings to purchase or promote on the platform. In return, LPs obtain rewards or charges gained from transactions that used their cryptocurrency. This technique permits the platform to facilitate buying and selling, whereas the token has larger probabilities of sustaining its worth.

How Do LP Tokens Work?

On decentralized exchanges, customers deposit two crypto belongings of equal worth right into a crypto liquidity pool—for instance, a buying and selling pair like ETH/USDC. These deposited belongings are locked in a wise contract to make it attainable for different customers to start out buying and selling.

Methods to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero price

In return, liquidity suppliers obtain liquidity supplier tokens (additionally referred to as liquidity pool tokens). These LP tokens symbolize your share of the general liquidity pool. That features the underlying belongings and the buying and selling charges generated. After that, when merchants swap belongings, the collected transaction charges are added to the pool, so while you redeem your pool’s LP tokens, you get again your share of the pool’s belongings plus charges generated—making it a solution to earn passive earnings.

As a result of the liquidity pool fluctuates with market volatility and token costs, returns can change over time. Some DeFi platforms provide extra rewards like liquidity mining, yield farming, or staking LP tokens to earn governance tokens (for instance, CRV tokens). LP tokens can be used throughout different protocols within the DeFi ecosystem for additional rewards.

LP tokens act as proof of contribution, giving crypto liquidity suppliers full management—you possibly can switch possession or exit anytime.

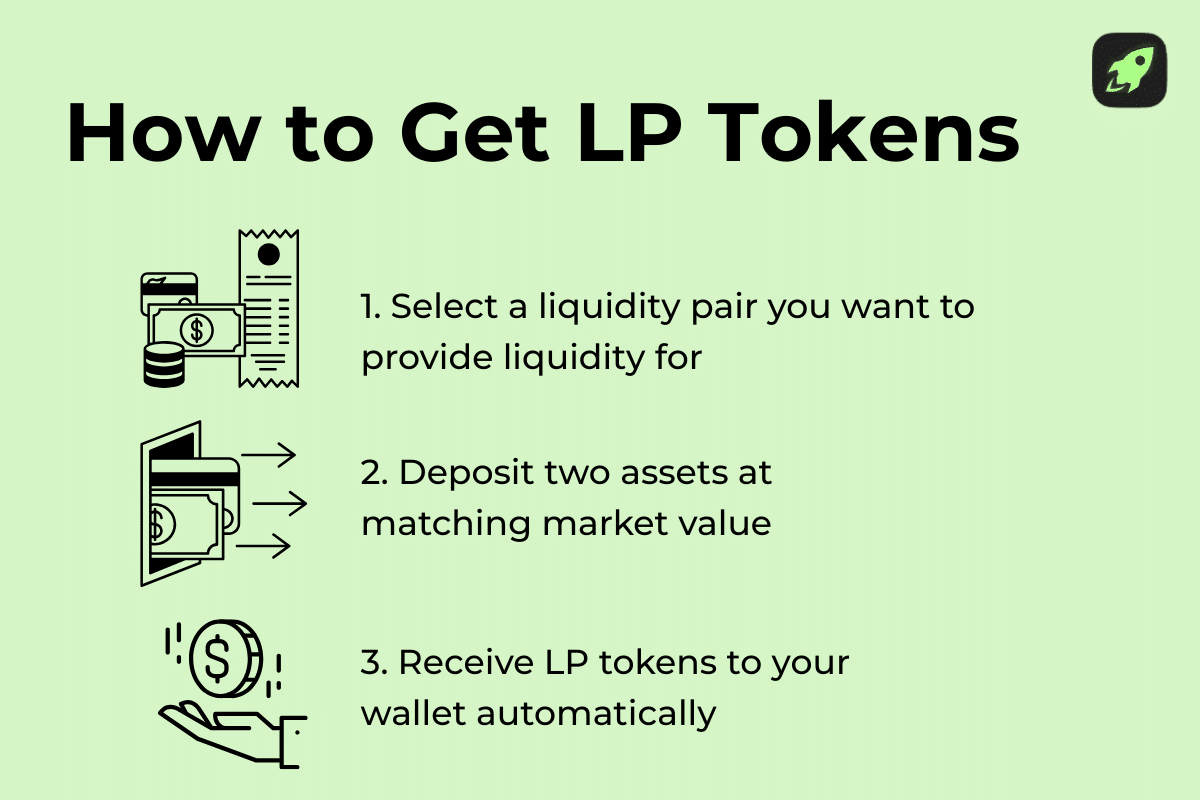

How Do You Get LP Tokens?

You may get LP tokens by offering liquidity to a pool on a DEX. Simply comply with this easy information:

Select a buying and selling pair, like ETH/USDC.

Deposit each belongings in equal worth into the pool.

As soon as the deposit is full, the protocol mechanically points LP tokens to your pockets.

You retain these LP tokens till you withdraw your liquidity, at which level you redeem them for the underlying belongings and earned charges.

What LP Tokens Symbolize

LP tokens symbolize the crypto belongings you set right into a liquidity pool. They’re your share of that pool. Let’s say you add ETH and USDC right into a pool. These tokens grow to be the underlying belongings of your LP tokens. In easy phrases, LP tokens are a receipt that exhibits which belongings you deposited and the way a lot of the pool you personal. As buying and selling occurs, charges are added to the pool, so the worth of your LP tokens grows or adjustments with the pool. Whenever you exit, you come the LP tokens and obtain the underlying belongings again, plus your share of the charges.

What Are the Use Circumstances of LP Tokens?

LP tokens are versatile, and so they don’t simply function proof of funding. They unlock a number of methods to make use of your liquidity place throughout the DeFi ecosystem and obtain extra earnings.

Collateral in a Mortgage

Some DeFi lending platforms allow you to use LP tokens as collateral. So, as an alternative of promoting your place, you possibly can borrow in opposition to it. This fashion, you retain publicity to the underlying belongings and potential buying and selling charges.

Yield Farming

LP tokens are sometimes utilized in yield farming applications. By depositing them into particular reward swimming pools, you possibly can earn additional tokens on high of normal buying and selling charges. That helps to extend your general returns, particularly over time.

LP Staking

With LP staking, you lock your LP tokens in a protocol to earn extra rewards or governance tokens. This can be a widespread solution to generate extra earnings from liquidity you already offered.

Why Are Liquidity Supplier (LP) Tokens Necessary?

Liquidity supplier (LP) tokens play an vital position as a result of they assist preserve decentralized exchanges operating easily. These tokens each reward customers who provide liquidity, and be sure that sufficient belongings can be found for buying and selling always. LP tokens serve liquidity suppliers as proof of their contribution and a transparent declare on the belongings and charges inside a liquidity pool. With out LP tokens, customers would have little motivation to lock their funds in swimming pools, and buying and selling would seemingly grow to be sluggish and costly. It’s by rewarding those that take part most actively that LP tokens assist honest pricing, decrease slippage, and environment friendly buying and selling throughout the decentralized finance ecosystem.

Methods to Earn Rewards with LP Tokens

To earn rewards with LP tokens, begin by offering liquidity to a pool on a decentralized alternate. After depositing two tokens of equal worth, you’ll obtain LP tokens. As folks commerce on the platform, you earn a portion of the charges mechanically.

To earn extra rewards, first examine if the platform affords yield farming or LP staking. If it does, you possibly can deposit your LP tokens into these applications. That means, you possibly can passively earn governance tokens that gives you voting energy on sure platforms.

Whenever you put your tokens to work, you continue to want to observe your place and withdraw when it suits your targets. Your rewards come from charges, incentives, and time within the pool.

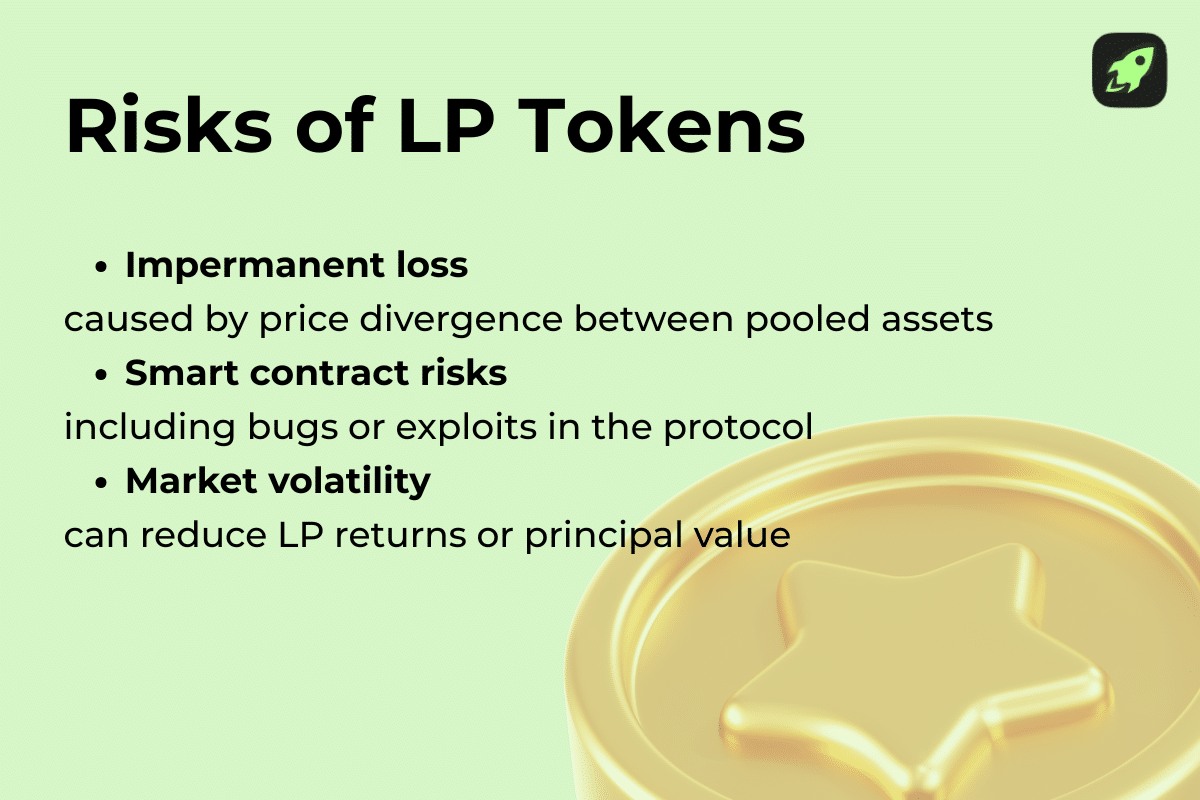

Dangers of Offering Liquidity

Offering liquidity will be rewarding, but it surely additionally comes with dangers newcomers ought to perceive.

One widespread danger is impermanent loss, which occurs when the costs of the 2 tokens you set right into a liquidity pool change in numerous instructions. As a result of the pool mechanically rebalances the tokens, you possibly can find yourself with much less complete worth than for those who had merely stored the identical tokens in your pockets as an alternative. There are additionally sensible contract dangers: if a protocol has bugs or vulnerabilities which can be exploited by a 3rd social gathering or, generally, from inside the challenge, funds could possibly be misplaced. Market volatility can have an effect on returns, and swimming pools with low liquidity could generate fewer charges. Lastly, some platforms provide additional rewards that rely on token costs, which might fluctuate.

Understanding these dangers is vital for those who’re trying into offering liquidity. In spite of everything, you’re leaving your cash in another person’s arms.

Can I Lose Cash With LP Tokens?

It’s attainable to lose cash with LP tokens, particularly for those who’re not conscious of the dangers. The worth of your LP tokens can change if the costs of the underlying tokens transfer sharply, which can lead to much less worth than for those who’d merely held them. Market volatility, low buying and selling exercise, or sudden drops in token costs can scale back returns. There are additionally technical dangers akin to sensible contract bugs or platform failures. Whereas buying and selling charges and rewards can offset some losses, LP tokens usually are not risk-free and understanding how swimming pools work helps you handle these dangers higher.

Staking LP Tokens to Earn Extra

Staking LP tokens is comparatively easy as soon as you determine how issues work. Plus, it’s a great way to earn additional rewards on high of buying and selling charges.

First, present liquidity to a pool and obtain LP tokens into your pockets.

Subsequent, examine if the platform affords an LP staking or yield farming program.

Deposit your LP tokens into the staking contract, and the protocol will begin rewarding you, normally with governance or incentive tokens.

Your rewards develop over time so long as your LP tokens stay staked. Whenever you’re prepared, you possibly can unstake your tokens and withdraw your liquidity, together with any earned rewards.

Are LP Tokens Value It?

LP tokens will be price investing in. Should you perceive how they work, contemplate the dangers, and select your swimming pools rigorously, you can begin offering liquidity and incomes rewards. Listed here are some issues to bear in mind:

Begin by searching for liquidity swimming pools with regular buying and selling exercise and well-known tokens, as these normally generate extra charges.

Contemplate whether or not additional rewards like LP staking or yield farming can be found.

All the time stability potential earnings in opposition to dangers akin to worth adjustments or sensible contract points.

Keep in mind that LP tokens work greatest for customers who plan to remain in a pool lengthy sufficient for charges and rewards so as to add up. Should you desire energetic administration and studying as you go, LP tokens is usually a useful gizmo.

Remaining Ideas

LP tokens assist preserve the decentralized finance ecosystem operating. They align incentives between merchants and liquidity suppliers, making decentralized exchanges extra environment friendly, accessible, and scalable. Whereas LP tokens provide alternatives to earn buying and selling charges and extra rewards, additionally they include dangers that shouldn’t be ignored.

Now you perceive how liquidity swimming pools work and what LP tokens symbolize. When you understand how to handle danger, LP tokens can grow to be a strong solution to take part in DeFi past easy buying and selling, and a sensible step in direction of turning into an energetic contributor to decentralized markets.

FAQ

Are LP tokens the identical as common crypto tokens?

No. LP tokens are totally different from common cryptocurrencies like BTC or ETH. They don’t symbolize a standalone asset. As a substitute, LP tokens symbolize your share of a liquidity pool, together with the underlying belongings you deposited and the charges the pool has earned.

What occurs once I take away my liquidity?

Whenever you take away your liquidity, you come (or “burn”) your LP tokens. In alternate, you obtain your share of the pool’s underlying belongings plus any buying and selling charges you earned, primarily based on the pool’s present state.

Can I take advantage of LP tokens in different DeFi protocols?

Sure. Many DeFi platforms allow you to use LP tokens for yield farming, staking, or as collateral for loans. This lets you earn extra rewards with out eradicating your liquidity from the pool.

Are LP tokens secure?

LP tokens are solely as secure because the protocol behind them. Dangers embrace sensible contract bugs, market volatility, and impermanent loss. Utilizing well-known platforms and understanding the dangers helps restrict potential losses.

What occurs while you burn LP tokens?

Burning LP tokens completely removes them from circulation. This course of occurs while you withdraw liquidity and permits the protocol to return your share of the pool’s belongings and earned charges.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.