Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value has tumbled 3.4% up to now 24 hours to commerce at $2,847 as of three:50 a.m. EST on a 31% surge in buying and selling quantity to $90.9 billion.

That drop within the ETH value comes as Ark Make investments continues to purchase the dip by accumulating extra shares in main Ethereum treasury agency BitMine Holdings.

Ark bought BitMine shares price $10.56 million throughout three ETFs (exchange-traded funds), including to $17 million acquired on Monday.

BitMine slid 6.6% on Wednesday to shut at $29.32, down roughly 24% over the previous 5 days.

Cathie Wooden loves shopping for Bitmine below $30!

ARK Make investments purchased 360,232 Bitmine shares right now!

😏😏😏$ETH / $BMNR pic.twitter.com/ycy80niqJS

— Kodi (BMNR) 📌 (@SweatyKodi) December 18, 2025

Ark Make investments’s continued accumulation displays CEO Cathie Wooden’s bullish stance. She anticipates a “actual break” in inflation subsequent 12 months, which might favor high-growth and innovation-focused property like crypto shares.

BitMine Chairman Tom Lee echoed this optimism, noting the corporate’s ongoing weekly ETH purchases even amid the market hunch. He additionally cited enhancing regulatory readability in Washington and stronger institutional participation as the reason why the “finest days for crypto” are nonetheless forward.

Ethereum Value Holds Sturdy Help

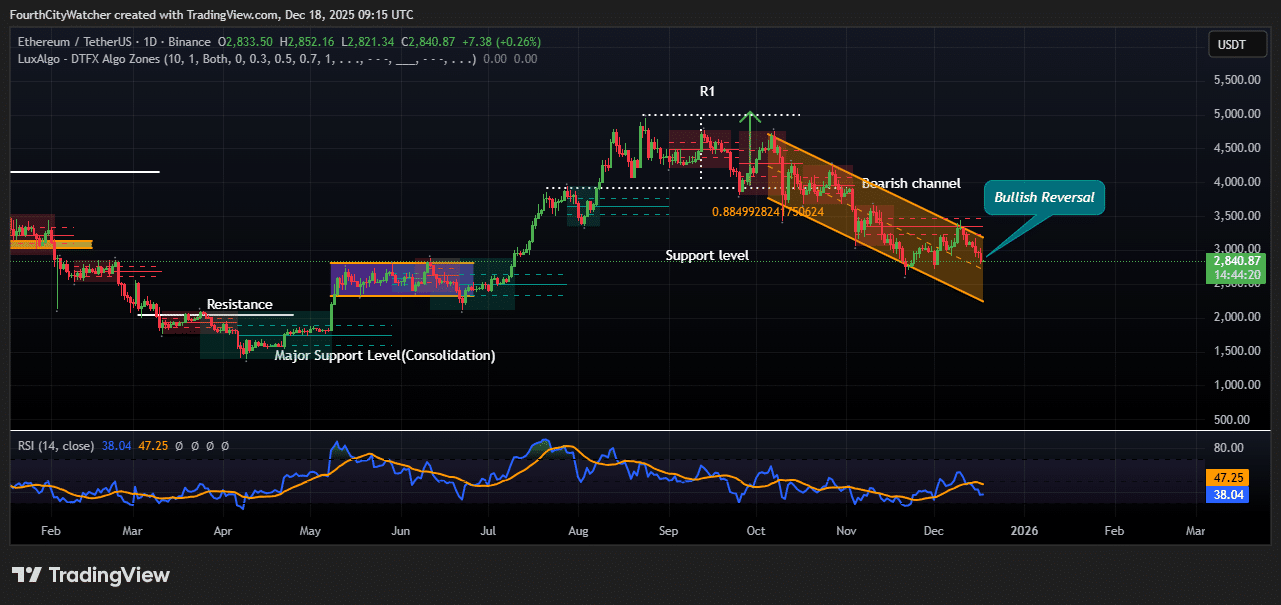

Ethereum value is buying and selling on the $2,847, help after a protracted bearish transfer. On the each day timeframe, ETH stays inside a descending (bearish) channel that has guided value motion decrease because the September peak close to the $4,800–$5,000 area.

Nonetheless, current candles counsel a possible bullish reversal try from the decrease boundary of this channel.

The ETH buying and selling pair topped out close to the R1 resistance zone, the place sturdy promoting strain emerged. That rejection marked the beginning of a gentle downtrend characterised by decrease highs and decrease lows.

The bearish channel clearly defines this development, with value respecting each the higher resistance line and the decrease help line a number of occasions, reinforcing its technical validity.

At present, ETH is bouncing from the decrease channel help, which additionally aligns with a key horizontal help degree round $2,800–$2,850. This confluence strengthens the realm as an vital demand zone. Traditionally, comparable reactions from such confluence zones have led to short- to medium-term reduction rallies.

ETHUSDT Evaluation Supply: Tradingview

The Fibonacci retracement drawn from the main swing low to the current excessive highlights the 0.886 retracement degree as a vital help space. Value is holding simply above this degree, which regularly acts as a final protection for bulls in corrective phases.

A sustained maintain above this zone will increase the chance of a reversal relatively than a continuation breakdown.

The RSI (14) is at present round 38–40, which is under the impartial 50 degree however above deep oversold situations. This means bearish momentum is weakening relatively than accelerating. Moreover, RSI has began to flatten and curl barely upward, usually an early sign that promoting strain is fading.

A bullish affirmation would require ETH to interrupt and shut above the midline and higher boundary of the bearish channel, adopted by a reclaim of the $3,100–$3,300 resistance zone.

A profitable breakout might open the door for a transfer towards $3,500, the place prior help has was resistance.

On the draw back, failure to carry above $2,800 would invalidate the bullish reversal setup and expose ETH to deeper losses towards $2,500 and probably $2,200.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection