Bitcoin is as soon as once more testing investor conviction because it struggles to reclaim the $90,000 stage, a worth zone that has now develop into a transparent psychological and structural barrier. After weeks of uneven worth motion and repeated failures to maintain upside momentum, sentiment throughout the market has shifted sharply.

Concern and apathy are more and more dominant, with a rising variety of analysts and members starting to name for a broader bear market. For a lot of buyers, the narrative has modified from shopping for dips to questioning whether or not the cycle has already peaked.

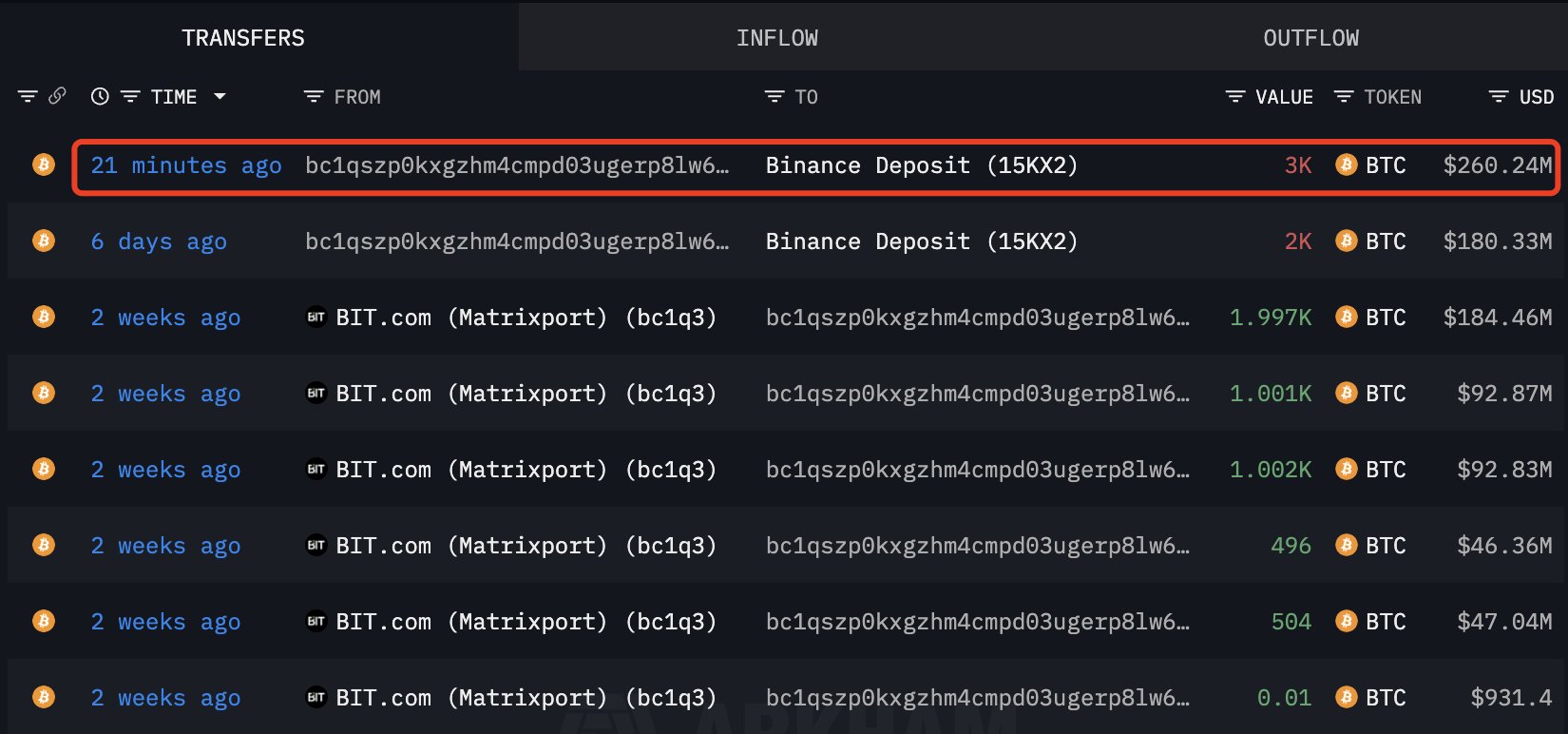

This deterioration in confidence is happening alongside renewed promoting stress from giant, well-capitalized gamers. In accordance with information from Arkham, two wallets linked to Matrixport deposited a mixed 4,000 BTC, value roughly $347.56 million, into Binance in the present day.

Matrixport is a big digital-asset monetary providers platform based by former Bitmain executives, providing merchandise together with crypto lending, structured merchandise, asset administration, and custody options.

Such giant inflows to exchanges are carefully watched by the market, as they usually precede distribution or hedging exercise, notably during times of heightened uncertainty. Whereas not each deposit interprets immediately into spot promoting, the timing of those transfers provides to the rising sense of warning.

Whether or not present demand can take up this provide and stabilize worth will possible decide if this part turns into a deeper correction—or the beginning of a extra extended bearish regime.

Trade Inflows And What They Imply For Bitcoin

Giant Bitcoin deposits to exchanges are virtually all the time interpreted by the market as a bearish sign, since they enhance the instant provide accessible on the market. In most historic instances, sharp spikes in alternate inflows have preceded durations of draw back volatility, reinforcing the notion that whales are getting ready to distribute into liquidity. Nonetheless, some buyers urge warning when studying this information in isolation, as not each alternate switch ends in spot promoting.

In sure eventualities, giant inflows could be linked to inner treasury administration, collateral rotation, or the opening of hedged derivatives positions relatively than outright liquidation. Establishments could transfer Bitcoin to centralized venues to publish margin for futures or choices, permitting them to hedge draw back danger with out promoting their underlying holdings.

In different instances, funds put together liquidity for over-the-counter settlements or cross-exchange arbitrage, actions that don’t essentially translate into sustained promoting stress on the spot market.

Wanting forward, Bitcoin’s worth motion over the approaching months will possible rely on whether or not these inflows are adopted by a transparent enhance in realized promoting quantity. If demand continues to soak up provide close to the $85K–$86K zone, the market may transition into a protracted consolidation part, permitting sentiment to reset.

Nonetheless, if alternate balances proceed to rise alongside weakening spot demand, draw back dangers stay elevated. In that situation, Bitcoin could revisit decrease help ranges earlier than any sturdy restoration can start.

Value Assessments Crucial Lengthy-Time period Assist

Bitcoin’s higher-timeframe construction exhibits a transparent lack of momentum after failing to carry above prior highs. On the weekly chart, BTC is now consolidating across the $86,000–$87,000 zone after a pointy rejection from the $110,000–$120,000 area. This space has develop into a vital demand zone, as worth is at present hovering close to the rising 200-day transferring common, which traditionally acts as a key pattern filter throughout cycle transitions.

The short-term construction stays fragile. Bitcoin is buying and selling under the 50-week transferring common, which has began to roll over, signaling weakening upside momentum. In the meantime, the 100-week transferring common continues to be trending greater and sits under the present worth, suggesting that the broader macro pattern has not totally damaged however is clearly underneath stress.

From a price-action perspective, BTC is forming a decrease excessive relative to the earlier cycle peak, whereas volatility stays compressed. This usually precedes a bigger directional transfer. If bulls fail to defend the $85,000 help decisively, the subsequent draw back targets sit close to the $78,000–$80,000 area, the place earlier consolidation occurred.

Conversely, any structural restoration would require a reclaim and weekly shut above $90,000, adopted by sustained acceptance above the 50-week common.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.