The Cardano value is as soon as once more within the highlight after the most recent FOMC determination, with ADA trying to stabilize following one other unstable macro week. With the Federal Reserve delivering its third consecutive 25-basis-point fee minimize, merchants initially rushed into threat belongings, however the response pale rapidly.

The large query now could be whether or not December will convey significant upside for Cardano crypto holders or extra chop because the market processes the implications of the brand new coverage path.

7d

30d

1y

All Time

FOMC Cuts for the Third Time – What Does That Imply?

Yesterday’s FOMC assembly delivered precisely what markets anticipated. The Federal Reserve minimize charges by 25 foundation factors for the third consecutive assembly, solidifying its shift from quantitative tightening towards an accommodative stance.

QT has formally wound down and introduced that it’ll make new $40Bn purchases of Treasury bonds over the following 30 days.

TODAY’S FED FOMC WAS VERY BULLISH.

The U.S. Fed might have simply began the following liquidity wave with 3 fee cuts and a $40 billion in Treasury shopping for.

At present’s FOMC assembly delivered one of many clearest shifts towards easing we’ve seen prior to now few years.

The Fed minimize charges… pic.twitter.com/hYnaOlaM0e

— Bull Idea (@BullTheoryio) December 10, 2025

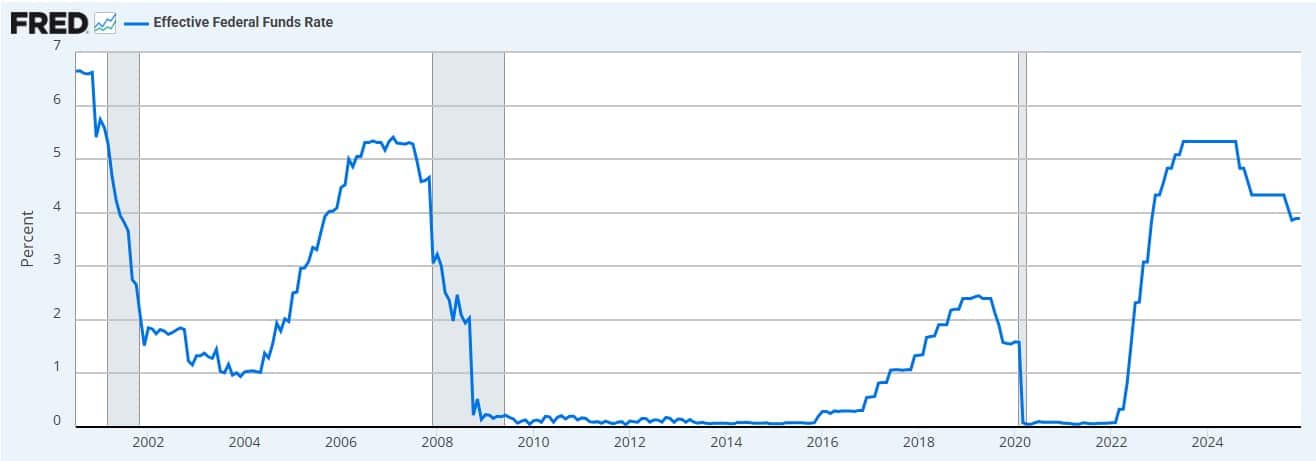

Traditionally, aggressive rate-cut sequences nearly at all times occurred in periods of deep monetary stress. The yr 200 noticed cuts shortly earlier than the dot-com collapse. The 2008 sequence tried to melt the influence of the worldwide financial disaster. In early 2020, emergency cuts arrived simply earlier than markets broke below the stress of the pandemic.

(Supply – stlouisfed)

Price cuts themselves weren’t the reason for these crises; they had been the warning indicators that the system was below pressure. Whereas reducing charges is normally seen as bullish for threat belongings, the response shouldn’t be at all times simple, as previous episodes present.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Cardano Responds to the Cuts, However Good points Fade Quick

ADA reacted strongly to the early wave of optimism, solely to retrace your entire transfer inside hours. One of these round-trip habits is typical when markets face main macro bulletins, particularly throughout cycles the place liquidity uncertainty is excessive. The speed minimize itself was no shock, however merchants had been making ready for it for days, turning the occasion right into a traditional sell-the-news setup.

(Supply – CoinGecko)

Regardless of the unstable response, Cardano’s fundamentals heading into Q1 2026 look structurally sturdy. The Midnight privateness sidechain is now reside with liquidity operations rolling into early subsequent yr. The ouroboros Leios scaling work continues to progress, laying the muse for significant throughput enhancements.

Privateness isn’t an add-on. It’s the lacking piece.

Contemporary off his keynote at Midnight Summit, @IOHK_Charles joined the #Unshielded podcast to interrupt down how Midnight is bringing rational privateness to blockchain—from Ethereum and Solana to Cardano and past.

Truthful-launch… pic.twitter.com/Xf6b2r6xdC

— Midnight (@MidnightNtwrk) November 25, 2025

Hydra’s settlement layer achieved document efficiency and is transferring nearer to wider deployment by governance upgrades. Treasury initiatives and cross-chain integrations present an ecosystem more and more centered on maturity and institutional readiness. A confirmed Tier-1 stablecoin for each Cardano and Midnight can also be anticipated early subsequent yr, a key piece for DeFi growth. This sequence of developments positions ADA properly, even when macro turbulence continues and headline volatility stays elevated.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

What Does Technical Evaluation Say?

On the 4-hour timeframe, ADA pumped roughly 13% instantly after the FOMC determination, retesting the decrease band of the 200-day EMA and SMA. Momentum stalled at that degree, which was rejected, pushing the value again towards the day’s opening. This sort of uneven motion is widespread round FOMC choices and doesn’t sign that ADA’s restoration try is over.

(Supply – TradingView)

RSI continues to point out bullish divergence, an indication that sellers could also be shedding power. The MACD stays inconsistent, often flipping optimistic however struggling to keep up momentum, on account of short-term volatility.

The each day timeframe, nonetheless, paints a noticeably stronger image. RSI is recovering above its common, indicating renewed momentum, whereas MACD is popping optimistic for the primary time because the October 10 flash crash. These are early indicators that ADA may construct a extra sustained uptrend if macro situations cooperate.

(Supply – TradingView)

The important thing resistance to look at is the $0.64 area. A clear breakout from that zone may open the trail towards the parabolic transfer hardcore hodlers are ready for. This might occur in December, notably if threat sentiment continues to enhance within the early phases of quantitative easing. Nobody can predict the precise end result, however what is obvious is that ADA stays a mainstay within the Layer-1 panorama.

Even when markets face deeper turbulence forward, Cardano value has the resilience, know-how, and group power to outlast the storm.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Cardano value rebound amid third consecutive fee cuts in December.

What’s the way forward for ADA?

The publish FOMC Bulls ADA Worth Restoration in Downtime Aftermath: Cardano Worth Prediction For December 2025 appeared first on 99Bitcoins.