With the Federal Open Market Committee (FOMC) assembly scheduled for as we speak, cryptocurrency markets have entered a cautious part of worth volatility. Bitcoin (BTC), Ethereum (ETH) and XRP are buying and selling in slim ranges as merchants pause for contemporary path from the U.S. central financial institution, extensively anticipated to carry rates of interest unchanged.

The shortage of near-term fee transfer has shifted focus squarely onto the tone and steering from Fed Chair Jerome Powell. His remarks on inflation, labor markets, and future fee expectations will seemingly have extra affect on sentiment than an unchanged coverage fee itself. Markets are reflecting this warning as BTC is consolidating beneath $90k, ETH is holding close to $3k, and XRP stays vary certain round $2, unable to maintain decisive upside past key resistances.

Bitcoin Worth Holds Floor as Merchants Await Macro Readability

Bitcoin’s worth motion has been devoid of sturdy directional conviction forward of the FOMC assembly. At present, BTC worth is hovering round $89,230, replicating a good vary motion. The sideways transfer displays broader macro uncertainty. The market just isn’t presently pricing steep fee cuts or hikes, as a substitute it’s bracing for Powell’s commentary on the financial outlook and inflation traits.

Bitcoin worth is on the sting of a pointy bounce and a break above $90k hurdle with sturdy quantity may reignite broader bullish participation. A break beneath $85k assist may usher in deeper decline forward.

Ethereum Eyes Key Assist as Macro Danger Persists

Ethereum worth has proven relative resilience in comparison with Bitcoin, managing to carry above the $3k assist zone. ETH’s consolidation mirrors Bitcoin’s vary habits, with merchants choosing defensive positioning moderately than aggressive directional bets forward of the FOMC assembly.

Within the final three months, Ethereum has examined a number of instances the assist zone of $2700 and the resistance zone of $3300. As ETH is on the decrease zone of the assist, it could showcase a bear lure and will break the higher fringe of the zone amidst the volatility forward. In that case, ETH worth breaks $3300 and will push towards $3500, whereas a break beneath $2700 could result in retesting $2500.

XRP Accumulates Close to Key Ranges as Sentiment Balances

XRP has showcased accumulation close to the important thing demand zone of $1.70-$1.90, however taking a pause amidst indecision amongst merchants forward of the Fed assembly. Regardless of current institutional curiosity, the token has not damaged decisively previous the hurdle of $2.40 and retested decrease ranges, suggesting that broader market danger sentiment stays muted.

Nonetheless, if XRP worth succeeds to interrupt previous $2.40, a serious upswing towards $3 adopted by $3.50 could possibly be seen within the close to time period. Till XRP maintains its demand zone of $1.70, the bullish construction stays intact.

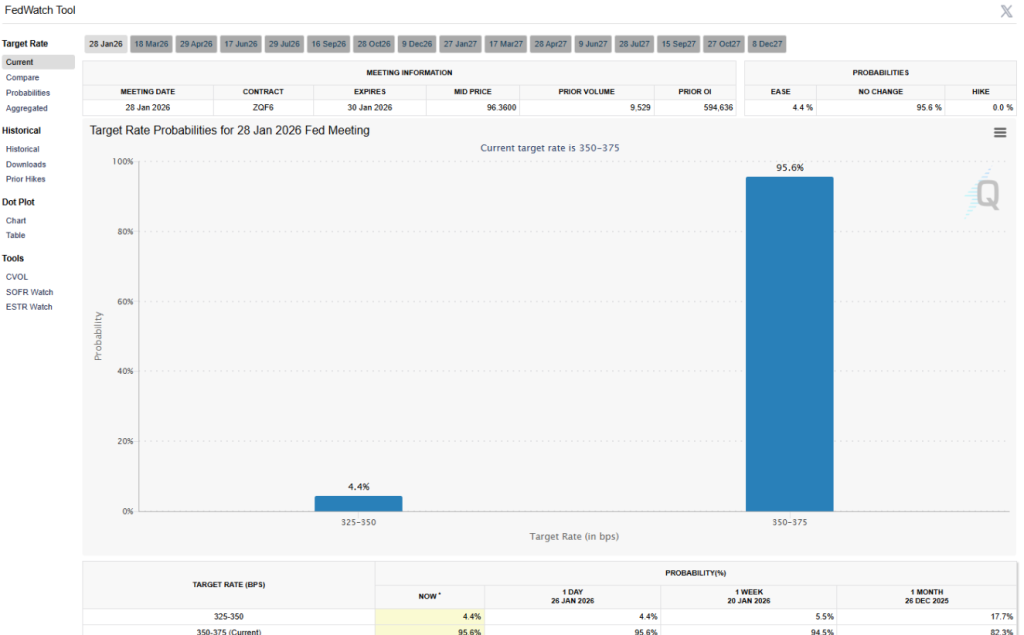

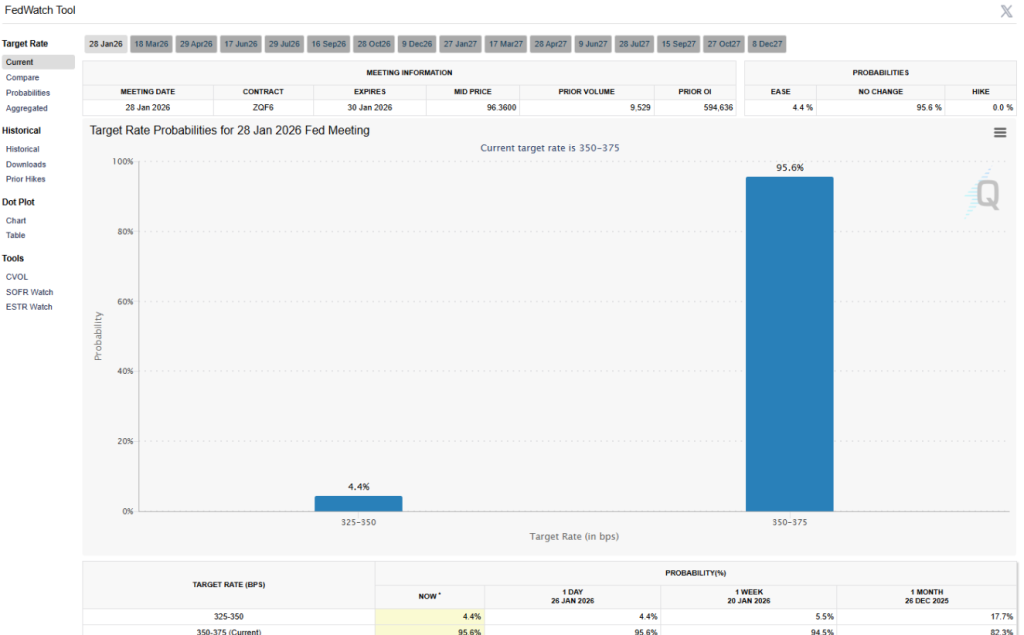

FedWatch Knowledge Confirms Give attention to Steering

In response to the CME FedWatch Instrument, markets are overwhelmingly pricing in a fee pause on the present vary. With the headline determination largely anticipated, consideration has shifted away from charges themselves.

As a substitute, merchants are centered on Jerome Powell’s ahead steering. Traditionally, crypto markets have reacted extra sharply to adjustments in tone than to unchanged coverage choices. This backdrop explains the present compression in volatility throughout Bitcoin, Ethereum and XRP and stays secure and structurally ready for volatility as soon as readability arrives.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict Editorial Tips primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to supply well timed updates about all the things crypto & blockchain, proper from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your personal analysis earlier than making funding choices. Neither the author nor the publication assumes accountability to your monetary decisions.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks could seem on our website. Ads are marked clearly, and our editorial content material stays completely impartial from our advert companions.