The KAIA value recorded a 39% intraday bounce, making it the highest asset of the day on the highest 100 belongings checklist. It has moved significantly into focus after a pointy 6-7 instances rise in derivatives exercise, spot quantity, and on-chain engagement was witnessed. As capital flows speed up and community utilization improves, this clearly displays demand. Because of this, market members are maintaining KAIA on the watchlist.

KAIA Worth Strengthens as Derivatives Exercise Surges

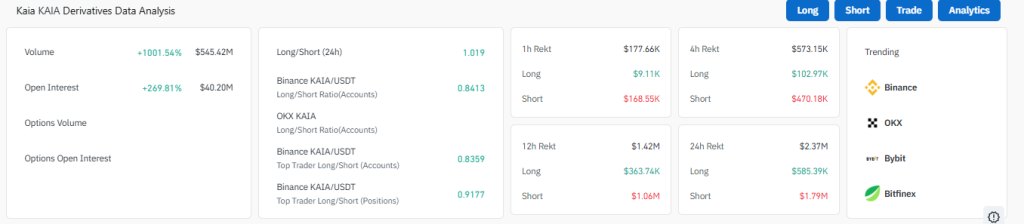

Momentum round KAIA value has intensified as futures markets mild up. Information from CoinGlass exhibits derivatives quantity surged over 1,000% to roughly $545 million, whereas open curiosity climbed almost 269% to $40 million. Notably, the lengthy/brief ratio rose above parity to 1.019, signaling bullish dominance amongst prime merchants, significantly on Binance.

When rising open curiosity accompanies rising quantity, it sometimes displays contemporary capital coming into the market slightly than merchants merely rotating positions. Because of this, the current growth factors towards heightened conviction slightly than short-lived volatility, reinforcing the short-term KAIA value forecast.

Along with futures exercise, spot market metrics have mirrored the bullish tone. At press time, 24-hour spot quantity reached roughly $145 million, whereas the liquidity ratio rose to 27.1%, indicating deeper order books and improved commerce effectivity.

Such circumstances usually help value stability throughout rallies, as increased liquidity reduces slippage and attracts bigger members.

Due to this fact, the alignment between derivatives and spot information suggests rising demand slightly than speculative imbalance, strengthening the general KAIA crypto outlook.

Social and Improvement Exercise Add Basic Assist

On-chain and santiment indicators have additionally improved. Social quantity surged notably this week as discussions round KAIA elevated throughout X, highlighting rising retail consideration.

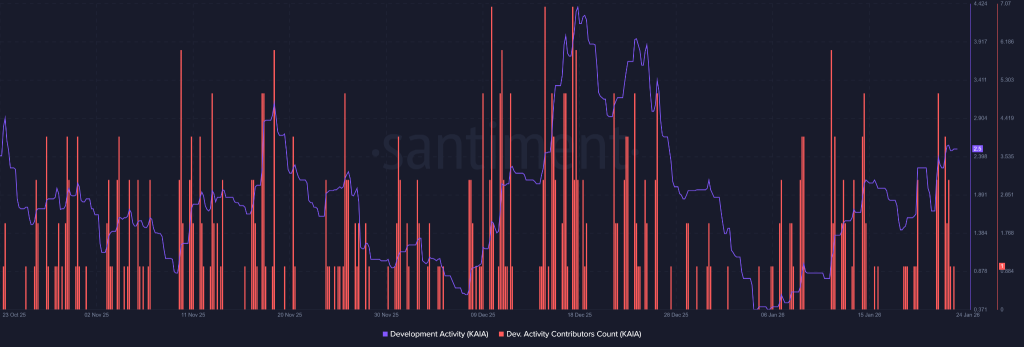

In the meantime, growth exercise and growth rely have trended increased, signaling energetic progress behind the scenes.

Traditionally, durations the place social engagement rises alongside growth development have coincided with increasing ecosystems slightly than momentary hype. Consequently, this backdrop gives further help to the present KAIA value USD construction.

Gaming Integration Acts as a Close to-Time period Catalyst

Past market information, real-world developments have contributed to the upside. KAIA obtained a lift after Metabora Video games partnered with Noestallagames to launch the Web3 title Magic Squad. Crucially, the sport launched fuel abstraction by way of the KAIA pockets, permitting customers to transact with out holding KAIA tokens.

This lowers entry obstacles for mainstream customers and enhances usability, doubtlessly rising transaction throughput and on-chain engagement. As adoption-focused integrations are inclined to drive natural utilization, this growth provides weight to the medium-term KAIA value prediction narrative.

KAIA Worth Chart Alerts a Technical Turning Level

From a technical standpoint, the KAIA value chart exhibits a decisive breakout from a multi-month descending channel. Worth has reclaimed each the 20-day and 50-day EMAs and is now approaching the 200-day EMA band close to a key resistance zone.

At round $0.085 with a market cap near $534 million, a profitable flip of the 200-day EMA aligned with the channel’s higher boundary and it might open a path towards the $0.21 space, implying a possible 150% extension. Conversely, rejection at this stage could end in additional consolidation because the market absorbs current good points, maintaining the KAIA value construction constructive however range-bound.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict Editorial Pointers primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked in opposition to respected sources to make sure accuracy, transparency, and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to offer well timed updates about all the pieces crypto & blockchain, proper from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market circumstances. Please do your individual analysis earlier than making funding selections. Neither the author nor the publication assumes duty to your monetary selections.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks could seem on our web site. Ads are marked clearly, and our editorial content material stays solely impartial from our advert companions.