Be a part of Our Telegram channel to remain updated on breaking information protection

Ethereum and the broader cryptocurrency market declined over the previous 24 hours as escalating geopolitical tensions between the US and European Union fueled threat aversion amongst traders.

In the meantime, conventional safe-haven property rallied sharply, with gold surging to contemporary file highs and silver additionally touching new peaks amid flight-to-quality flows triggered by President Trump’s renewed tariff threats in opposition to a number of European nations over the Greenland dispute.

Spot gold climbed 1.1% to round $4,725 per ounce as of early buying and selling on January 20, approaching its all-time excessive close to $4,795 set late final 12 months, in accordance with market information.

The metallic has prolonged its relentless bull run into 2026, bolstered by safe-haven demand as traders brace for potential transatlantic commerce disruptions.

The silver worth additionally superior by almost 1% to hit a brand new file excessive of $95.3/oz.

ETH worth was buying and selling at $3,095 as of 4:29 a.m. EST after a 3.6% drop within the final day, because the crypto market additionally dropped over 2% to a $3.15 trillion market capitalization, in accordance with Coingecko information.

Crypto Market Rattled As Trump Tariffs Dent Threat

Through the weekend, Trump threatened that he would impose import tariffs of as much as 25% on a number of main European nations, together with Denmark, France, and the US, till they reached a deal at hand over Greenland to Washington.

The US president’s calls for had been extensively rejected by European leaders, with France seen making ready retaliatory financial measures in opposition to the USA.

The trade between the 2 areas has sparked deep losses throughout world risk-driven markets, on considerations over a possible dissolution of NATO, as Trump plans direct steps to get Greenland.

So as to add to the tensions, Trump has mentioned that he’ll impose a 200% tariff on French wines and champagnes, as he desires French President Emmanuel Macron to affix his Board of Peace Initiative aimed toward resolving world conflicts.

“I’ll put a 200% tariff on his wines and champagnes, and he’ll be part of, however he doesn’t have to affix,” Trump mentioned.

JUST IN – Reporter: Are you able to reply to Macron saying he is not going to be part of the board of peace?

Trump: No person desires him… I’ll put a 200% tariff on his wines and he’ll be part of pic.twitter.com/S5pTcTbTvn

— Insider Paper (@TheInsiderPaper) January 20, 2026

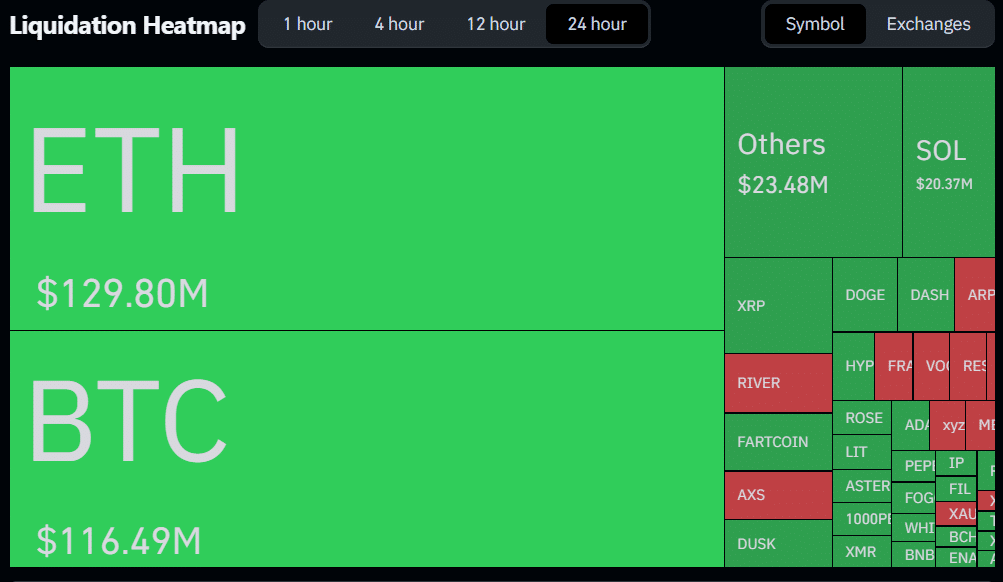

This despatched jitters within the crypto area, with complete liquidations coming in at $361 million, $124 million being from Ethereum longs alone.

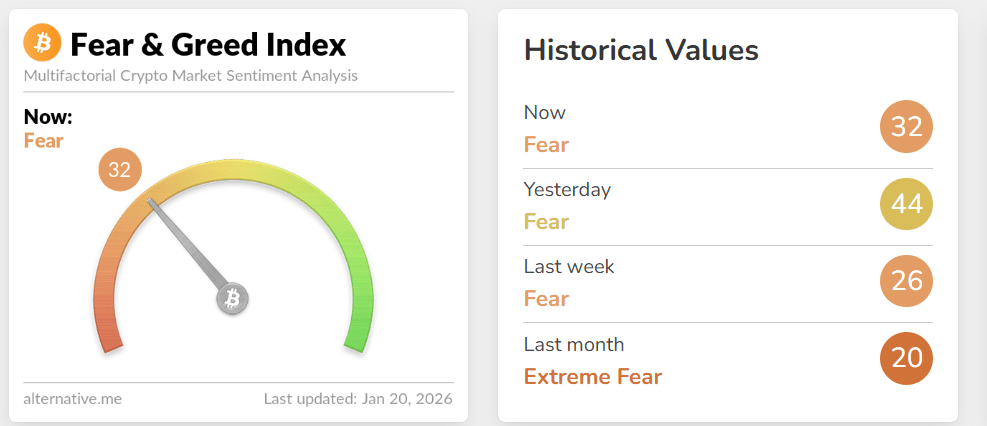

Furthermore, the crypto Worry & Greed Index stays within the worry zone after a number of weeks of maximum worry, which exhibits that investor sentiment has softened however remains to be cautious, and the market could also be undervalued.

Ethereum Value Evaluation: The Drop Is A Warning Signal

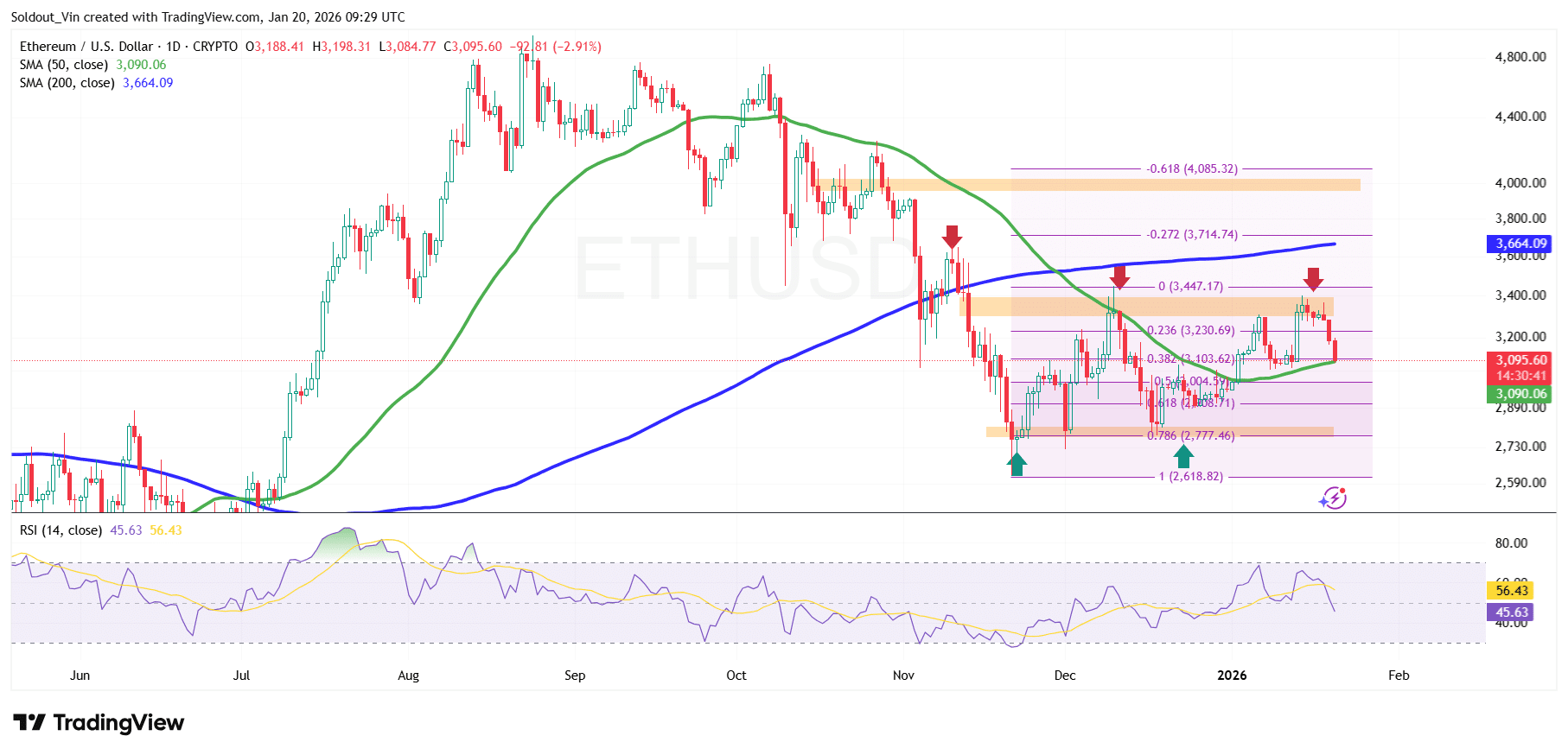

Ethereum’s worth is at present buying and selling across the $3,050–$3,150 vary, making an attempt to stabilize after a pointy decline. Whereas consumers are defending the $3,000 psychological assist, the general worth motion suggests warning fairly than power.

The current transfer decrease adopted a robust rejection from the $3,600–$3,700 area, the place Ethereum failed to carry above the 50-day Easy Shifting Common (SMA).

This barrier triggered sustained stress from the bears, sending the worth down towards the $2,750–$2,800 demand zone, a traditionally essential assist space aligned with the 0.786 Fibonacci retracement.

Ethereum is at present buying and selling close to the 50-day SMA ($3,090), which is performing as short-term assist. Nonetheless, the worth stays decisively under the 200-day SMA close to $3,660, which continues to behave as a significant overhead resistance.

Momentum indicators additionally replicate this warning. The Relative Power Index (RSI) is hovering round 45, under the impartial 50 degree. This means that bearish momentum has eased, however bullish momentum has not but returned.

ETH Value Prediction: $2,600 Stage In Sight

Failure to carry $3,000 would enhance the danger of one other pullback towards $2,800–$2,750 close to the 0.786 Fibonacci degree. A breakdown under this demand zone would expose the $2,620 cycle low, which nonetheless acts as a essential degree for the bulls to defend.

Conversely, it could try one other push towards the $3,350 resistance zone, an space that has repeatedly capped and barred any upside strikes.

A breakout above this vary may open the door for a retest of $3,660 on the 200-day SMA degree.

For Ethereum to realistically re-enter a bullish construction and goal the $4,000 area, it could want a sustained pattern reversal, beginning with a decisive shut above the 200-day SMA.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection