After a powerful rebound throughout the first few days of 2026, Bitcoin (BTC) worth has been rejected round $94k. The flagship coin dropped under $91k on Wednesday, January 7, amid rising midterm concern of additional bearish influence from the unwinding Yen carry commerce.

Bitcoin Suffers Liquidity Crunch Amid Unwinding of Yen Carry Commerce

Bitcoin and the broader altcoin market are dealing with heightened short-term promoting strain because the Yen carry commerce continues to unwind. The current rate of interest hikes by the Financial institution of Japan have triggered buyers to shift risk-off on crypto property because of the unwinding of the Yen carry commerce.

The liquidity outflow from Bitcoin and altcoins to repay loans denominated in Yen weighed down on midterm bullish sentiment. Through the December schedule, the BoJ elevated its price to 0.75%, thus making Yen loans much less worthwhile on the international scale.

In keeping with buying and selling knowledge from TradingView, BTC worth closed within the fourth quarter of 2025 in a bearish outlook, amid sturdy international fundamentals, thus correlated with the Yen.

Supply: X

Bitcoin’s liquidity outflow is clearly seen by means of the $243 million in money outflows from the U.S. spot BTC ETFs.

Larger Image

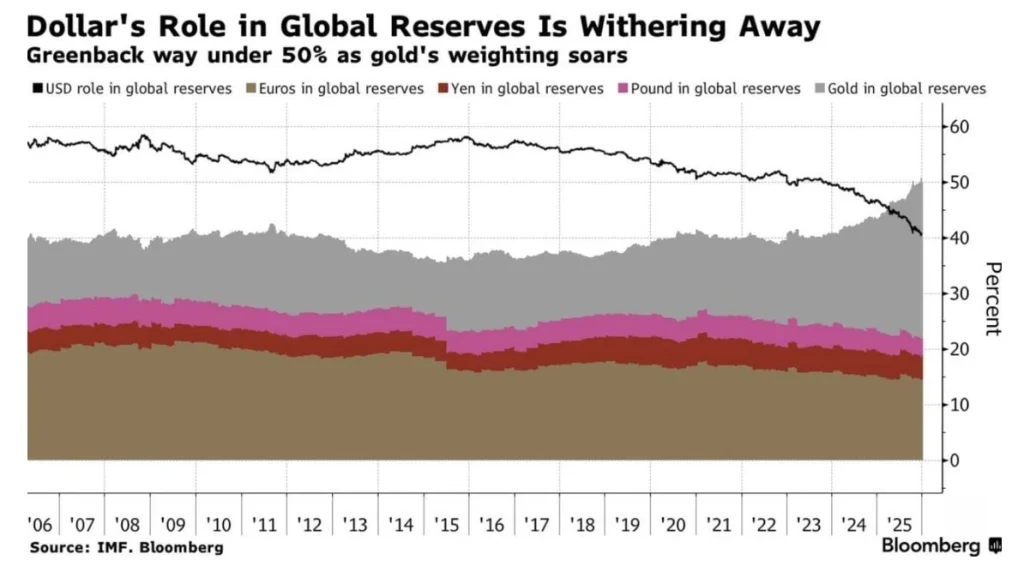

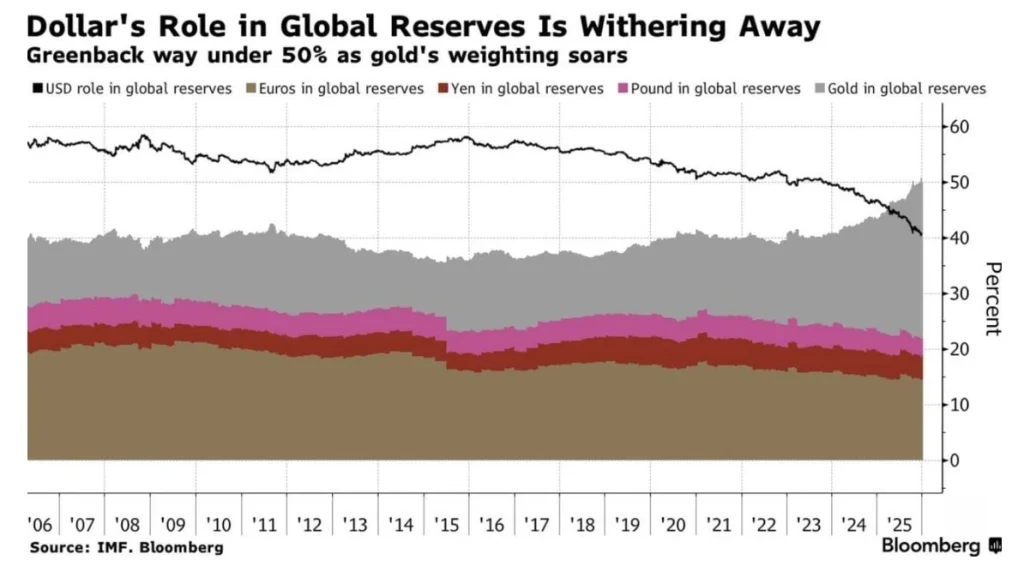

In keeping with Tom Lee, a well-liked Wall Road analyst closely invested in crypto, the parabolic rise of Gold in 2025 is an indicator of crypto bullish sentiment in 2026. In keeping with Bloomberg knowledge, the U.S. greenback was lately overtaken by Gold because the dominant international reserve.

Supply: X

With Bitcoin adopted globally as a digital Gold, the flagship coin is well-positioned to rally exponentially within the coming months. Furthermore, the continued Quantitative Easing (QE) by the Federal Reserve will set off a risk-on funding mode within the close to future.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict Editorial Tips primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to offer well timed updates about all the things crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the creator’s personal views on present market situations. Please do your personal analysis earlier than making funding selections. Neither the author nor the publication assumes duty in your monetary selections.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks might seem on our web site. Commercials are marked clearly, and our editorial content material stays completely unbiased from our advert companions.