Massive information from the Federal Reserve as they simply injected $2.5 billion into the US banking system in an in a single day repo, including to the $120 billion pumped into the market this yr. However, regardless of this huge liquidity increase, Bitcoin worth continues to be lagging and struggling to interrupt the $90,000 resistance.

On a optimistic word, Visa has formally declared crypto as “mainstream” in 2025, with stablecoins and AI funds main the cost. These all occur when gold hit a document excessive of $4,562 per ounce, and silver is now at $79. Each metals have been on a run these days, identical to the sample seen in 2020 when gold ($2,075/oz) and silver ($29/oz) hit their peaks, which then began large rallies in different belongings.

With a lot bullish information surrounding Bitcoin, it’s a bit shocking to see its worth lag behind, particularly with gold and silver maintaining breaking their highs.

So, may Bitcoin be subsequent in line for a significant surge?

7d

30d

1y

All Time

Gold and Silver at All-Time Highs because the Federal Reserve Injected Extra Liquidity

Monitoring again to 2020, after gold and silver reached their highs, Bitcoin had an enormous breakout. It jumped from $11,500 to $29,000 by the top of the yr, which was a 150% achieve. By 2021, the crypto market cap shot up from about $390 billion to over $2 trillion. Conventional shares just like the S&P 500 additionally noticed good features, with a 7% rise in 2020, adopted by a 27% enhance in 2021.

(supply – Curvo)

Now, with the Federal Reserve persevering with to pump liquidity into the market, Bitcoin may comply with an analogous path, and the bear market would possibly lastly finish. The query is: when will that occur?

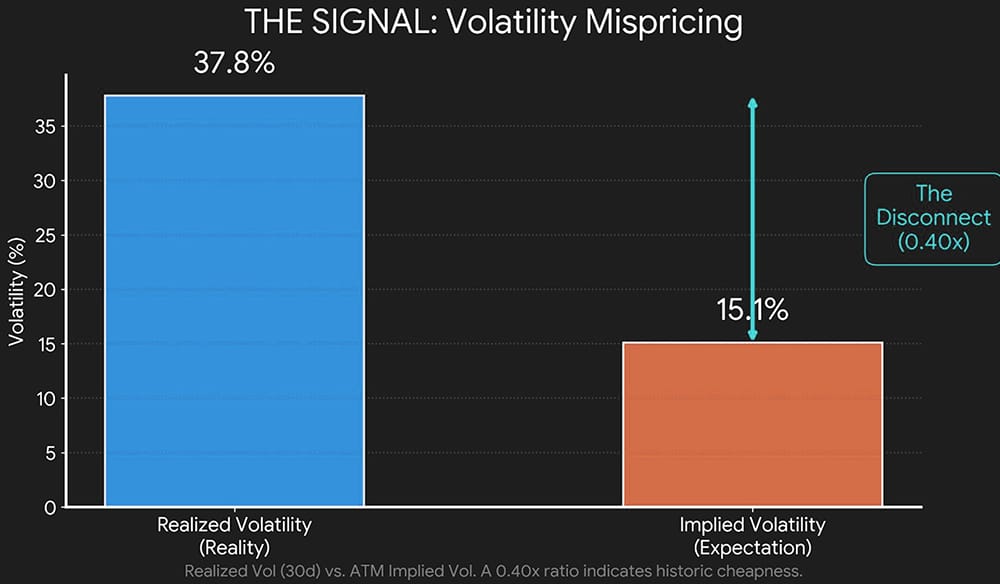

Proper now, Bitcoin is caught beneath $90,000, however there’s an enormous volatility anomaly taking place which may result in a breakout. Realized volatility is sitting at 37.8%, which reveals that Bitcoin is definitely shifting, however implied volatility is far decrease at 15.1%.

This mismatch between what the market expects and what’s truly taking place is traditionally unsustainable, and it’d as properly ship Bitcoin worth upward quickly.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The Volatility Anomaly and Bitcoin Value

So why is that this volatility mismatch so essential? As a result of, merely put, it’s placing Bitcoin on sale proper now. Individuals are leaping into name choices (which guess on increased costs), anticipating that the worth of Bitcoin will go up. Because of this, sellers need to chase the rising costs to satisfy these bets, which flip small rallies into a lot greater runs.

There’s additionally the truth that a 4chan consumer who appropriately predicted Bitcoin’s October peak at $126,198 is now forecasting a Bitcoin worth of $250,000 by 2026. Gemini’s CEO, Tyler Winklevoss, additionally tweeted that Bitcoin is “Gold 2.0” and mentioned, “Wait until the world realizes.” These can all be the sparks wanted for subsequent yr’s bull run.

Wait til the world realizes that bitcoin is gold 2.0

— Tyler Winklevoss (@tyler) December 26, 2025

As Satoshi Nakamoto famously mentioned,

For those who don’t consider me or don’t get it, I don’t have time to attempt to persuade you, sorry.”

It’s a powerful assertion, however with the whole lot taking place out there proper now, Bitcoin is poised to interrupt out in an enormous manner.

Regulate the Federal Reserve’s strikes and the way they could push Bitcoin worth increased. The market may be lagging proper now, however historical past reveals that crypto all the time catches up in essentially the most violent manner.

For those who don’t consider me, I don’t have time to attempt to persuade you.

DISCOVER: 10+ Subsequent Coin to 100X In 2025

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Knowledgeable Market Evaluation.

Ripple Pushes $1.3T By way of XRP Rail: Hype or Actual Utility?

Ripple’s fee community simply reported processing round $1.3 trillion in transactions in Q2 2025 by its XRP-powered On‑Demand Liquidity (ODL) product. However XRP barely broke out on the information, as merchants weighed adoption headlines in opposition to a still-choppy altcoin market.

7d

30d

1y

All Time

If XRP strikes trillions, why doesn’t the worth moon each quarter? Our earlier evaluation on XRP worth prediction explains a key level for us: utility and worth don’t all the time transfer in sync. Massive companions might route funds by XRP however maintain little of it, and Ripple nonetheless sells tokens from its escrow, which provides ongoing provide.

Solana Value Slides Whereas Utilization Booms: What’s Actually Going On?

Solana worth has trended decrease since January, even because the community racks up document utilization and income. We watched SOL lag whereas the chain generated over $271 million in Q2 2025 charges and funds, greater than another community for 3 straight quarters.

The hole between worth and exercise sits inside an even bigger crypto story: cash rotating between Layer-1s, meme cash, and ETFs whereas regulators and establishments concentrate on Solana.

7d

30d

1y

All Time

Kaito and Avantis Crypto Rallying Towards All Odds: Choosing The Subsequent Runner Heading Into 2026

Kaito crypto has had a tough time this yr. Hell, most locally wrote it off, calling it achieved for after staking and losses and a few guarantees that have been left unfulfilled. Then there’s Avantis crypto, which has additionally been on a tear, climbing 25% in worth.

Right this moment, Kaito shocked everybody with a 26% soar in worth. Those that managed to scoop it up when it was at its lowest, not me, are seeing first rate returns now, whereas others who purchased increased are undoubtedly feeling the ache. The sudden comeback reveals how rapidly issues can change when an asset catches a second wind.

7d

30d

1y

All Time

Avantis, alternatively, has surged which began earlier than Christmas and was pushed by an enormous spike in decentralized trade (DEX) exercise on Base. Once more, not me, individuals who managed to get in on Avantis on the proper time have seen some very nice features as liquidity flooded into the market.

7d

30d

1y

All Time

The season is nice, Christmas brings pleasure, however crypto. Meh.. Nevertheless, each Kaito and Avantis are proving they will run in opposition to the dangerous crypto market circumstances.

Learn the total story right here.

EU’s Stricter Crypto Tax Reporting Guidelines Take Impact January 2026: Is DAC8 A Crackdown On Crypto?

The European Union (EU) is able to implement DAC8 for crypto tax transparency. What’s DAC8, you ask? The Directive on Administrative Cooperation is a complete directive that can basically change how crypto transactions are monitored and taxed.

DAC8 was adopted by the council of EU in October 2023. Now, beginning 1 January 2026, crypto exchanges will likely be required to gather and report detailed consumer and transaction knowledge to nationwide tax authorities. Nevertheless, firms have been granted six months, till 1 July 2026, to realize full compliance. However will DAC8 achieve success in closing vital gaps in crypto tax reporting? Or is it one other crackdown on crypto?

Put together your self for 2026 & rising surveillance of your monetary knowledge:

DAC8 within the EU

, SEC surveillance within the U.S.

, obligatory KYC on each centralized on-ramp, and blockchain evaluation firms tracing each transaction..

Your 8-step plan to remain alive within the new…

— CR1337 (@CR1337) December 9, 2025

To stop tax evasion, DAC8 is supposed to offer tax authorities with visibility over crypto holdings and transfers just like what they at the moment have for conventional financial institution accounts and securities.

Learn the total story right here.

The publish Crypto Market Information Right this moment, December 27: Federal Reserve Injected $2.5 Billion into the Market, Bullish for Bitcoin Value appeared first on 99Bitcoins.