Decentralized finance has reshaped cash transfers as we all know them. The brand new requirements for pace and safety challenged conventional fee methods, forcing them to adapt. That’s how PayFi got here to be. Combining the qualities of crypto funds with the accessibility and user-friendly interfaces delivered by common banks, PayFi is making its method into folks’s on a regular basis lives. And it’s not going to cease.

What Is PayFi? (Cost Finance Defined)

PayFi, brief for Cost Finance, describes utilizing blockchain for fee methods. International monetary transactions may be processed with out intermediaries with the pace and safety that we get from decentralized finance. There aren’t any correspondent banks concerned, and the method is absolutely managed by sensible contracts. This helps to scale back charges and bypass many points related to conventional fee methods. This defines PayFi—seamless, programmable funds constructed for pace and effectivity, which is why increasingly more fee processors are turning to this apply.

How PayFi Works: From Funds to Financing

From the consumer’s viewpoint, it’d seem to be PayFi works identical to your common financial institution: you press “ship” and your cash goes to the recipient. However the interior mechanisms of economic transactions on this system are solely completely different. Under is a step-by-step rationalization of how PayFi works.

Step 1: A Enterprise Points an Bill (a Future Cost)

The vendor creates an bill for items or providers, itemizing the quantity and due date. For the client, it appears to be like like a standard invoice, however for PayFi, it’s a file that may be moved and financed on-chain.

Step 2: The Bill Turns into a Tokenized Receivable (RWA)

The created bill is transformed right into a digital token representing the receivable (a real-world asset, or RWA). This course of is known as tokenization, which makes the receivable tradable, traceable, and programmable on the blockchain.

Step 3: Good Contracts Join the Purchaser, Vendor, and Lender

The bill phrases are encoded in a wise contract that robotically hyperlinks all events. It enforces all of the circumstances—fee date, penalty, proof of supply—that in conventional funds could be introduced on paper. The sensible contract additionally triggers further actions like funding or reimbursement with out handbook intervention. It basically fills the position usually occupied by a 3rd celebration, thus eliminating middleman costs.

Step 4: A Liquidity Supplier Funds the Receivable Upfront

A lender or liquidity supplier buys the tokenized bill, instantly paying the vendor (minus a charge or low cost). The supplier then holds the receivable and collects the complete fee from the client later—successfully financing the vendor’s money circulate.

Step 5: Settlement with Stablecoins or On-Chain Forex

When the bill matures, the client pays on-chain utilizing stablecoins or one other crypto. The sensible contract verifies fee and releases funds to the liquidity supplier. Any charges or settlements are executed robotically. Thus, PayFi supplies a seamless fee expertise with clear transactions.

As a result of PayFi works on the rules of decentralized finance (DeFi), it permits companies to ship and obtain cash by means of real-time funds with immediate settlement. Since the whole lot is programmable, PayFi initiatives can add options like escrow, factoring, or recurring billing with out counting on a number of intermediaries.

Tips on how to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

Key Elements of the PayFi Ecosystem

PayFi is used for several types of monetary transactions, like cross-border funds, crypto funds, and a lot extra. All these can’t exist with no few key components. Each PayFi community depends on these parts for cost-efficiency and monetary inclusion.

Good Contracts

Good contracts are digital agreements that robotically execute when sure circumstances are met, making certain safe and clear transactions. In PayFi, they take away the necessity for intermediaries present in conventional finance, decreasing transaction charges and fraud dangers. Since transactions happen straight between events, companies and customers profit from immediate settlement and smoother fee processing with out hidden charges.

Actual-World Belongings (RWAs)

RWAs symbolize tokenized variations of property like invoices, actual property, or commodities. By bringing tangible property on-chain, PayFi connects conventional finance with world funds. RWAs additionally seize the time worth of cash, giving traders and enterprise homeowners entry to usable funds quicker. This bridge between actual property and digital methods permits companies to develop extra effectively in world finance.

Stablecoins

Stablecoins are digital currencies pegged to steady property just like the US greenback or euro. They make cross-border and crypto funds predictable by minimizing volatility. Inside PayFi, they assist obtain immediate settlement and easy foreign money conversion in the course of the transaction course of. This lets enterprise homeowners and customers make world funds simply, with out worrying about fluctuating charges or hidden charges.

Study extra: What Are Stablecoins?

Wallets and Custody

Wallets are important for holding and transferring digital property securely. In PayFi, they act like digital financial institution accounts, enabling customers to handle usable funds anytime with simply an web connection. Superior custody options and encryption improve safety, decreasing fraud dangers. PayFi wallets simplify cross-border and conventional funds, making world transactions each protected and quick.

Liquidity Suppliers

Liquidity suppliers provide the capital that retains fee processing easy in PayFi’s ecosystem. They fund real-world property upfront, making certain immediate settlement and fast entry to cash for enterprise homeowners. By bridging lenders and debtors straight, PayFi removes a number of intermediaries, decreasing transaction charges and dashing up world finance operations.

Learn extra: What Is Liquidity in Crypto?

Retailers and SMEs

Retailers and small-to-medium enterprises (SMEs) are on the core of PayFi. It helps them obtain cash globally with out hidden charges or banking delays. PayFi’s decentralized construction permits enterprise homeowners to develop throughout borders, settle for crypto funds, and revel in immediate settlement, all whereas reducing prices and decreasing fraud dangers tied to conventional funds.

Off-Chain Information & Oracles

Oracles act as bridges between blockchain and the true world. They bring about off-chain knowledge—like alternate charges or credit score scores—into sensible contracts to make PayFi smarter. This ensures safe and clear transactions whereas permitting real-time selections in fee processing. By combining blockchain automation with exterior knowledge, oracles assist PayFi combine seamlessly with world finance methods and conventional funds.

PayFi vs. Conventional Finance (TradFi) vs. DeFi

Advantages of PayFi for Companies and Builders

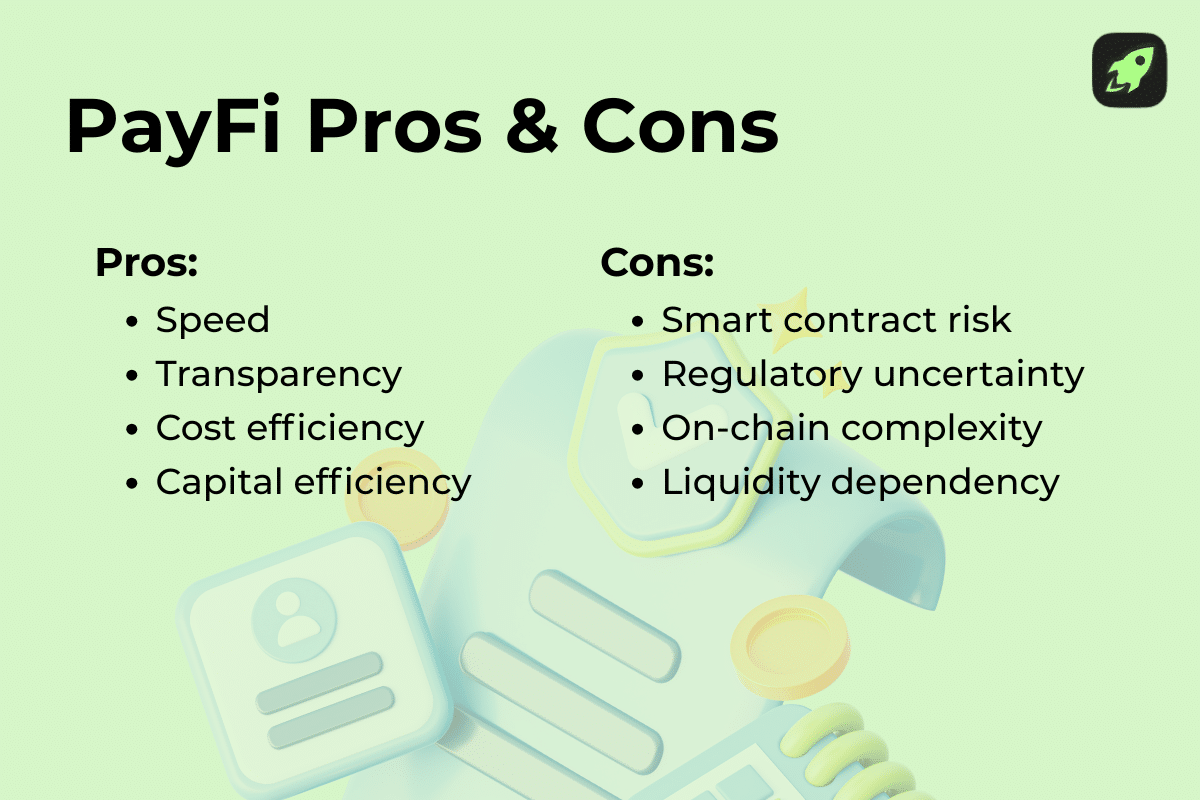

Like every new improvement, PayFi focuses on the largest problems with conventional finance and presents an answer. Alongside the way in which, it additionally presents some attention-grabbing benefits.

Sooner Settlement & LiquidityPayFi has near-instant funds, giving companies speedy entry to funds as a substitute of getting to attend days for financial institution processing. Actual-time settlement improves money circulate, liquidity, and monetary planning. For builders, this pace helps seamless world transactions inside apps, working 24/7—even on weekends and holidays.

Clear & Auditable TransactionsEvery PayFi transaction is recorded on an immutable blockchain ledger. This transparency simplifies audits, reduces fraud, and ensures funds are absolutely traceable. Builders can construct instruments that confirm and monitor funds in actual time with out counting on opaque intermediaries or legacy methods.

Decrease Prices & Fewer IntermediariesTraditional methods rely upon banks, card networks, and processors, every including their very own charges. PayFi allows direct transfers between sender and receiver, reducing out middlemen and decreasing transaction prices. This effectivity advantages companies managing high-volume funds and builders integrating cost-effective monetary APIs.

Capital Effectivity for SMEs & MerchantsSmall and medium-sized companies usually battle with delayed funds. PayFi’s real-time settlements enhance liquidity and permit for quicker reinvestment, decreasing reliance on loans or credit score strains. Builders constructing fintech instruments can provide higher consumer experiences with clear and predictable money flows.

Limitations of PayFi

Regardless of its advantages, PayFi can’t at all times assure absolute safety. Builders want to remain alert when constructing PayFi methods. Not all methods handle to keep away from issues, even after a number of audits. Understanding what may go unsuitable might assist customers hold their cash protected.

Good Contract RisksSmart contracts automate PayFi operations, however they’re solely as protected as their code. Bugs or vulnerabilities may be exploited, even after audits. Builders should comply with strict coding requirements, carry out audits, and use safe frameworks.

Liquidity & Default RisksPayFi methods usually rely upon liquidity suppliers. In instances of market stress, liquidity shortages or collateral drops can delay or block transactions. Clear reserves and sensible contract safeguards assist scale back these dangers.

Regulatory UncertaintyDigital asset laws range throughout areas. Companies and builders should keep knowledgeable, use compliant companions, and be able to adapt as legal guidelines evolve.

Adoption ChallengesMainstream customers stay cautious of decentralized methods. Clear UX, training, and partnerships with conventional establishments may also help construct belief.

RWA Valuation RisksTokenized real-world property could also be mispriced or poorly audited. Initiatives ought to depend on impartial, clear audits and recurrently publish valuation stories to make sure confidence and investor safety.

Actual-World PayFi Use Instances and Examples

Actual-world PayFi use circumstances are shortly increasing throughout industries. In e-commerce, retailers use PayFi to simply accept crypto and stablecoin funds immediately, avoiding excessive transaction charges and delays from conventional processors. Cross-border companies profit from real-time settlements with out hidden costs or foreign money conversion hassles. Freelancers and gig staff obtain world funds in seconds, bettering money circulate. In DeFi, PayFi allows tokenized invoices and on-chain lending, permitting companies to entry liquidity quicker. Even remittance providers are being reinvented—households can ship cash worldwide with minimal prices. General, PayFi bridges conventional finance and blockchain, making world funds quicker, fairer, and extra inclusive.

Remaining Ideas

PayFi represents a serious shift in how we deal with funds and monetary transactions. By combining blockchain know-how, sensible contracts, and tokenized real-world property, it presents quicker settlements, decrease charges, and higher transparency than conventional methods. Companies, SMEs, and builders profit from improved liquidity, capital effectivity, and seamless integration with trendy purposes. Whereas there are nonetheless some challenges, like sensible contract dangers and regulatory uncertainty, PayFi’s potential to make funds extra inclusive, safe, and environment friendly is simple. As adoption grows and know-how advances, PayFi is poised to redefine world finance for each folks and companies.

FAQ

Can I take advantage of PayFi right now, or is it nonetheless new?

Sure, PayFi is operational and gaining traction. It allows real-time, low-cost funds utilizing blockchain and stablecoins, facilitating 24/7 world transfers with out intermediaries.

Why would anybody use PayFi as a substitute of PayPal or a financial institution?

PayFi presents immediate settlement, decrease charges, and world accessibility with out the necessity for conventional banking intermediaries. It integrates decentralized finance (DeFi) protocols, permitting customers to earn yield whereas making funds.

Does PayFi use actual cash, or simply crypto?

PayFi helps each fiat currencies and cryptocurrencies. Customers can transact utilizing stablecoins, comparable to USDC, or convert between crypto and fiat seamlessly.

Do I would like crypto to attempt PayFi?

Not essentially. Whereas PayFi facilitates crypto transactions, many platforms provide user-friendly interfaces that enable people to interact with out prior cryptocurrency information.

Is PayFi just for firms, or can common folks use it too?

Common people can use PayFi. It supplies entry to world funds, permitting customers to ship and obtain cash, pay payments, and even earn yield by means of DeFi protocols.

Disclaimer: Please word that the contents of this text are usually not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.