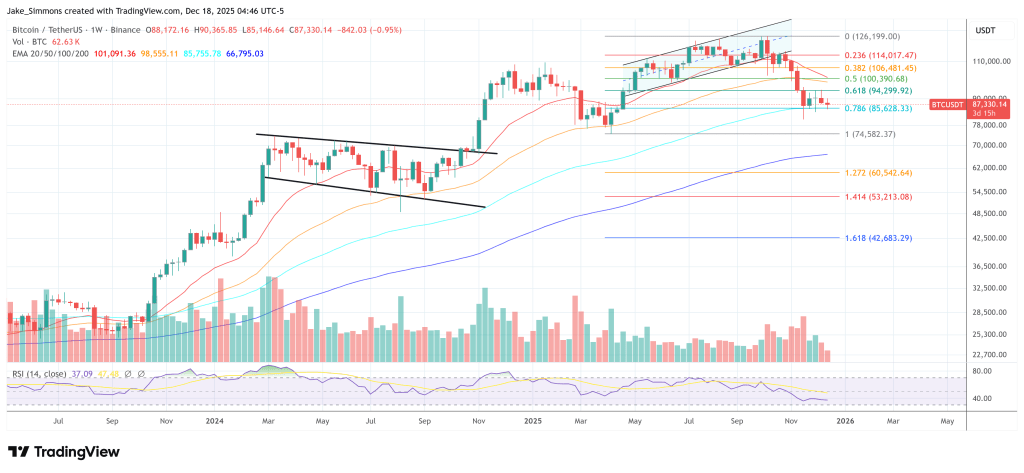

International Macro Investor (GMI) head of macro analysis Julien Bittel posted a bitcoin “oversold RSI” roadmap on X, arguing the market has tracked it carefully and tying the setup to a broader view that the cycle may run into 2026—an outlook he says would render the standard “four-year cycle” framework out of date.

“Lots of people have been asking for an replace on this chart, so I’ll simply go away this right here for anybody who must see it,” Bittel wrote, sharing a chart of bitcoin’s common worth path after RSI falls under 30, with the RSI breach marked as t=0. “This reveals the common BTC trajectory following an oversold RSI studying, with RSI falling under 30 at t=0.”

Can Bitcoin Skyrocket To $180,000 In Simply 90 Days?

Bittel stated the overlay has matched the present tape. “Thus far, it’s been fairly bang on,” he wrote. The “common market path” line rises sharply over the weeks that comply with. The chart reveals a steep rally inside 90 days after t=0, with the BTC worth doubtlessly surging close to the $180,000 space.

Associated Studying

Nonetheless, Bittel emphasised the chart shouldn’t be meant to be a precision forecast. “No, it received’t be good,” he wrote, including that “assuming the bull market isn’t already over, it’s a helpful chart to bear in mind.” He additionally warned that the rebound course of will be uneven: “bases can take time to kind and often include loads of chop earlier than the larger up-move kicks in.”

He reiterated the conditional nature of the framework in blunt phrases. “If you happen to assume the bull market is over and we are actually going through twelve months of ache, this chart shouldn’t be for you. Transfer alongside…”

The larger level, Bittel stated, is that the acquainted cycle narrative shouldn’t be taken with no consideration. “Until you consider the 4-year cycle continues to be in play, which we don’t, this chart ought to maintain up contextually over time,” he wrote. “As we’ve outlined many instances, based mostly on our work on the enterprise cycle, the present path of monetary circumstances, and our expectations for general liquidity, the steadiness of possibilities is that this cycle extends effectively into 2026.” In that situation, he added, “the 4-year cycle is lifeless.”

Bittel additionally challenged the frequent assumption that bitcoin’s rhythm is essentially “in regards to the halving.” “Keep in mind, the 4-year cycle was by no means in regards to the halving, regardless of widespread perception that it’s, however as a substitute has all the time been pushed by the general public debt refinancing cycle,” he wrote, including that post-COVID that dynamic “was pushed out by one 12 months.” He now argues the cycle is “formally damaged” as a result of “the weighted common maturity of the debt time period construction has elevated.”

He framed the macro backdrop by way of debt-service strain and liquidity response. “The larger image is that there’s nonetheless an unlimited quantity of curiosity expense that must be monetized, which has far exceeded GDP progress,” Bittel wrote.

Reactions throughout crypto X ranged from enthusiastic to skeptical. The ₿itcoin Therapist replied: “$180,000 BTC in 90 days.”

Associated Studying

LondonCryptoClub (@LDNCryptoClub) stated the chart “traces up with our considering,” tying the narrative to what it known as the Fed’s “not QE QE” dynamics and “liquidity video games” between the Treasury and the central financial institution. The account nonetheless anticipated turbulence into year-end—“noise and chop into 12 months finish (which is detrimental liquidity)”—earlier than “these basic drivers begin to see BTC reconnect with the bull pattern,” including that “sentiment seems sufficiently dangerous for a BTC transfer increased to be essentially the most hated commerce to begin 2026!”

Others struck a extra sardonic tone. “precision-grade hopium right here,” wrote doug funnie (@cryptoklotz), whereas nonetheless sketching a conditional path ahead: Nonetheless assume so long as BTC survives (ie doesn’t shut within the $70k’s and begins grinding down or accepting there), there’s a believable path to new highs on the sooner aspect in 2026. Simply must survive the ‘transition zone’ of 4 12 months deterministic selloors exhausting, after which ending up in an ungainly spot because the music retains taking part in.”

Capriole Investments founder Charles Edwards was extra important of the statistical grounding, urging a broader check set: “Now re run this with 100 occurrences, not 5 throughout up solely.”

For merchants, Bittel’s put up successfully combines a tactical sign with a regime name: the RSI sub-30 template might map the rebound path, however solely “assuming the bull market isn’t already over,” and solely in a world the place, as he put it, “the steadiness of possibilities” favors a cycle that “extends effectively into 2026.”

At press time, BTC traded at $87,330.

Featured picture created with DALL.E, chart from TradingView.com