Bitwise Chief Funding Officer Matt Hougan is pushing again in opposition to one of many loudest bearish narratives round bitcoin treasury firm Technique (MSTR, previously MicroStrategy): that it may very well be compelled right into a liquidation of its roughly $60 billion bitcoin stack. In his newest CIO memo, Hougan writes bluntly that “Michael Saylor and Technique promoting bitcoin shouldn’t be considered one of” the true dangers in crypto.

Will Technique Promote Its Bitcoin?

The fast set off for market nervousness is MSCI’s session on whether or not to take away so-called digital asset treasury firms (DATs) like Technique from its investable indexes. Almost $17 trillion in property tracks these benchmarks, and JPMorgan estimates index funds may need to promote as much as $2.8 billion of MSTR whether it is excluded.

MSCI’s rationale is structural: it views many DATs as nearer to holding firms or funds than working firms, and its investable universes already exclude holding buildings comparable to REITs.

Hougan, a self-described “deep index geek” who beforehand spent a decade modifying the Journal of Indexes, says he can “see this going both means.” Michael Saylor and others are arguing that Technique stays very a lot an working software program firm with “advanced monetary engineering round bitcoin,” and Hougan agrees that this can be a affordable characterization. However he notes that DATs are divisive, MSCI is at the moment leaning towards excluding them, and he “would guess there may be not less than a 75% probability Technique will get booted” when MSCI pronounces its determination on January 15.

He argues, nevertheless, that even a removing is unlikely to be catastrophic for the inventory. Massive, mechanical index flows are sometimes anticipated and “priced in effectively forward of time.” Hougan factors out that when MSTR was added to the Nasdaq-100 final December, funds monitoring the index had to purchase about $2.1 billion of inventory, but “its value barely moved.”

He believes a few of the draw back in MSTR since October 10 already displays traders discounting a possible MSCI removing, and that “at this level, I don’t suppose you’ll see substantial swings both means.” Over the long run, he insists, “the worth of MSTR relies on how effectively it executes its technique, not on whether or not index funds are compelled to personal it.”

The extra dramatic declare is the so-called MSTR “doom loop”: MSCI exclusion results in heavy promoting, the inventory trades far under NAV, and Technique is one way or the other compelled to promote its bitcoin. Right here Hougan is unequivocal: “The argument feels logical. Sadly for the bears, it’s simply flat incorrect. There’s nothing about MSTR’s value dropping under NAV that can power it to promote.”

He breaks the issue right down to precise stability sheet constraints. Technique, he says, has two key obligations: about $800 million per yr in curiosity funds and the necessity to refinance or redeem particular debt devices as they mature.

Smaller DATs Are The Larger Downside

On curiosity, the corporate at the moment has roughly $1.4 billion in money, sufficient to “make its dividend funds simply for a yr and a half” with out touching its bitcoin or needing heroic capital markets entry. On principal, the primary main maturity doesn’t arrive till February 2027, and that tranche is “solely about $1 billion—chump change” in contrast with the roughly $60 billion in bitcoin the corporate holds.

Governance additional reduces the chance of compelled promoting. Michael Saylor controls round 42% of Technique’s voting shares and is, in Hougan’s phrases, an individual with extraordinary “conviction on bitcoin’s long-term worth.” He notes that Saylor “didn’t promote the final time MSTR inventory traded at a reduction, in 2022.”

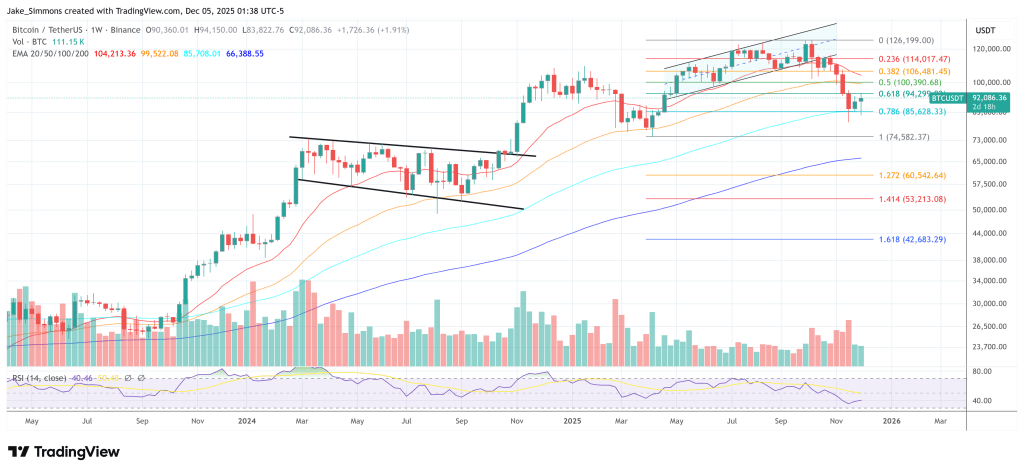

Hougan concedes {that a} compelled liquidation can be structurally important for bitcoin, roughly equal to 2 years of spot ETF inflows dumped again into the market. He merely doesn’t see a reputable path from MSCI index mechanics and fairness volatility to that consequence “with no debt due till 2027 and sufficient money to cowl curiosity funds for the foreseeable future.” On the time of writing, he notes, bitcoin trades round $92,000, about 27% under its highs however nonetheless 24% above Technique’s common acquisition value of $74,436 per coin. “A lot for the doom.”

Hougan ends by stressing that there are actual points to fret about in crypto—slow-moving market construction laws, fragile and “poorly run” smaller DATs, and a probable slowdown in DAT bitcoin purchases in 2026. However on Technique particularly, his conclusion is direct: he “wouldn’t fear concerning the influence of MSCI’s determination on the inventory value” and sees “no believable near-term mechanism that might power it to promote its bitcoin. It’s not going to occur.”

At press time, BTC traded at $92,086.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.