Be a part of Our Telegram channel to remain updated on breaking information protection

JPMorgan is dealing with renewed criticism from the Bitcoin group, this time over its plan to launch Bitcoin-linked leveraged notes.

The funding financial institution submitted a submitting to the US Securities and Change Fee (SEC) earlier this week to launch a sort of leveraged funding product that’s tied to the Bitcoin value.

It goals to present buyers the chance to attain 1.5x the good points or losses that BTC experiences via 2028, whereas additionally providing 30% draw back safety. The notes are scheduled to launch in December.

However what appeared like one other step towards mainstream adoption for Bitcoin has triggered the ire of Bitcoiners.

JPMorgan’s Product Stated To Put Promoting Strain On Bitcoin Treasury Corporations

Some say it places the Wall Avenue banking big in direct competitors with BTC treasury firms and contend that the financial institution now has an incentive to marginalize firms like Technique, the biggest company BTC holder globally, to advertise its personal structured monetary product.

Among the many critics is BTC advocate Simon Dixon.

“The Monetary Industrial Advanced (FIC) has rolled out one more speculative, leveraged paper product designed to wedge itself between you and your Bitcoin,” Dixon mentioned on X.

JP MORGAN APPLIES TO LAUNCH NEW BITCOIN-BACKED BOND

The Monetary Industrial Advanced (FIC) has rolled out one more speculative, leveraged paper product designed to wedge itself between you and your Bitcoin.

The FIC is now brazenly testing a full suite of Bitcoin-linked… pic.twitter.com/BWHrmgXgyt

— Simon Dixon (@SimonDixonTwitt) November 26, 2025

He warned that JPMorgan’s notes might “set off margin calls on Bitcoin-backed loans, power promoting strain from Bitcoin treasury firms in down markets, and create manufactured shopping for strain in up markets so the FIC can place themselves lengthy earlier than the general public even realises the sport has begun.”

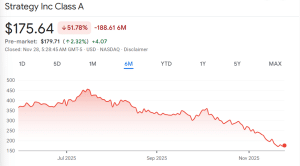

The timing of the announcement can also be being scrutinized as a result of Technique’s inventory has plummeted over 51% within the final six months and 18% previously month.

Technique share value over the previous 6 months (Supply: Google Finance)

Bitcoiners Name For Boycott Of JPMorgan

Bitcoiners began calling for a boycott of the monetary establishment final week after its analysts warned in a analysis observe that MSCI might drop Technique’s MSTR from its indexes. A call on the matter is predicted by Jan. 15.

There may be hypothesis on X that JPMorgan’s warning is a part of a much bigger choreographed transfer to convey down Technique and different Bitcoin treasury companies after which power buyers to purchase into merchandise that the financial institution affords.

“So JP Morgan sells shares of MSTR, will increase margin req. from 50-95%, pushes for Technique’s exclusion from the MSCI index, has a historical past of manipulating BTC value, requires lower cost, waits for -35% drawdown and broadcasts a Bitcoin backed bond,” wrote BTC advocate The Bitcoin Therapist in an X submit to his greater than 250K followers.

So JP Morgan sells shares of MSTR, will increase margin req. from 50-95%, pushes for Technique’s exclusion from the MSCI index, has a historical past of manipulating BTC value, requires lower cost, waits for -35% drawdown and broadcasts a Bitcoin backed bond.

And that is only a coincidence? pic.twitter.com/9lOzrdLqaQ

— The ₿itcoin Therapist (@TheBTCTherapist) November 26, 2025

In the meantime, Ran Neuner believes that JPMorgan, MSCI, and key political gamers “moved in sync” to strain MSTR as a part of a broader effort to focus on “Trump’s complete crypto ecosystem.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection